We believe the answer is yes, and we’re excited to share some early examples of how our team is using ChatGPT as a knowledge interface.

Let’s jump right in with how we got started. Valor is raising Fund 3, and so we are spending a lot of time thoughtfully answering RFP questions. When doing RFPs for example or answering consultant questions, ChatGPT is an elegant way to fit answers to the required text parameters used by various platforms. Every fund of funds, consultant or large LP platform has its own “investor relations” interface. It can be challenging to manually write the same material into dozens of different text parameters.

Since ChatGPT was launched last year, it has become our go-to tool to help with things like summarizing and grammar checking texts. ChatGPT gave us the perfect platform to build a solution that saves hours of investment relations time a week.

AI In Investor Relations, RFP Writing, Etc.

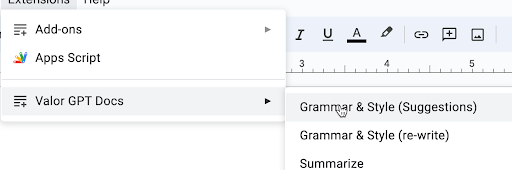

To help our team do this, we created a custom Google Docs plugin for our own ChatGPT. Straight from a Google Document, our team member can select text and then quickly apply a pre-set prompt. Here’s what that looks like:

If we choose Summarize, ChatGPT can use the same exact text, and simply change the number of characters or word counts. Our setting on our unique ChatGPT instance holds it “close” and does not allow it to embroider or get creative on the facts. This is a setting around tone, style and creativity that we’re able to manage well.

AI Supporting Startup Sourcing

Once we saw how effective this was, we all wanted to do more. I looked for other areas where there is a tedious amount of data entry, and where genAI can support more effective startup sourcing. We review hundreds of startups per month from many different sources. William Leonard, who leads sourcing, spends a lot of time researching, reaching out and adding ‘possible’ startups into our own proprietary database. (Our CRM is built on Salesforce, as is our entire unique investment lifecycle management system.)

Thanks to a new feature that OpenAI introduced (functions) we decided to take our text optimizer a few steps further and build a tool that can really facilitate the work we do daily for our portfolio sourcing.

Meet Vic, Valor’s AI

We ended up building V1 of our own GPT4 powered AI assistant, which we named Vic. Vic can:

- read webpages, such as blog posts, articles, company web sites, etc.

- look up companies and contacts in Pitchbook

- look up data in our own Salesforce CRM, plus, when asked,

- add contacts or startups to our CRM directly.

Vic is a baby bot, and we expect to expand its capabilities quite a bit. Here’s where we are today–let’s use a real sourcing example.

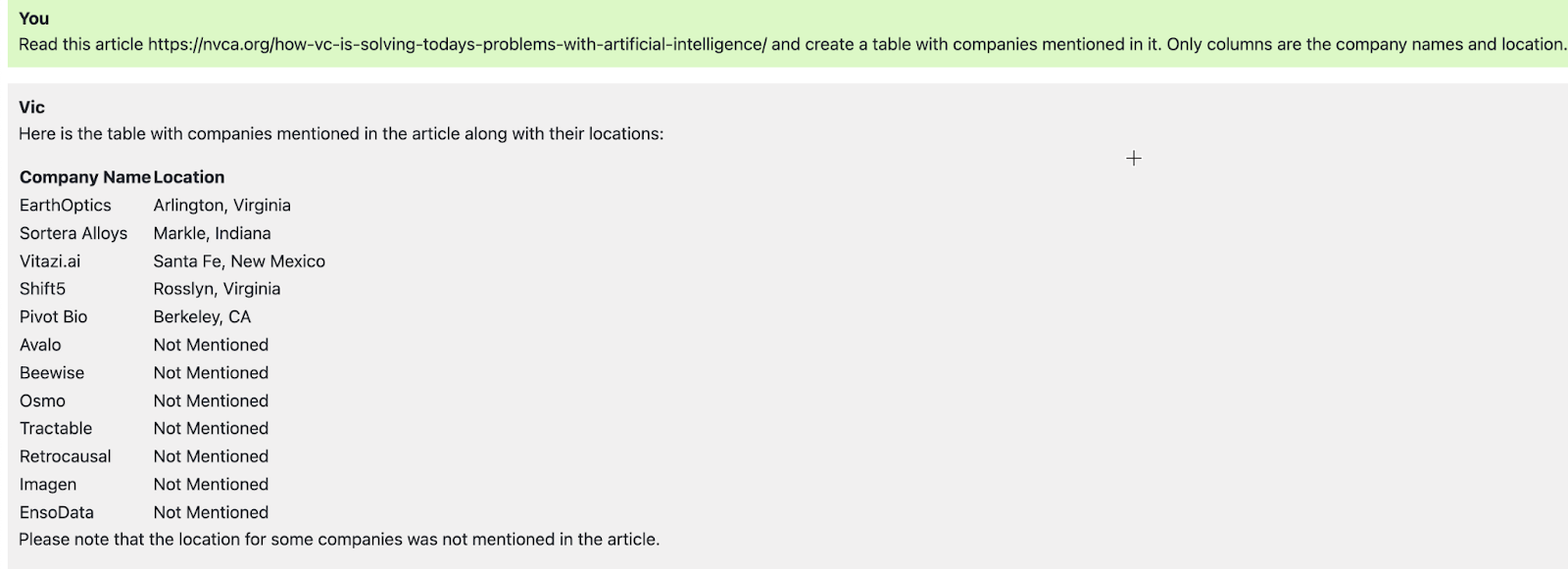

Now, when we read an interesting article, we can ask Vic to find the startups mentioned (step 1):

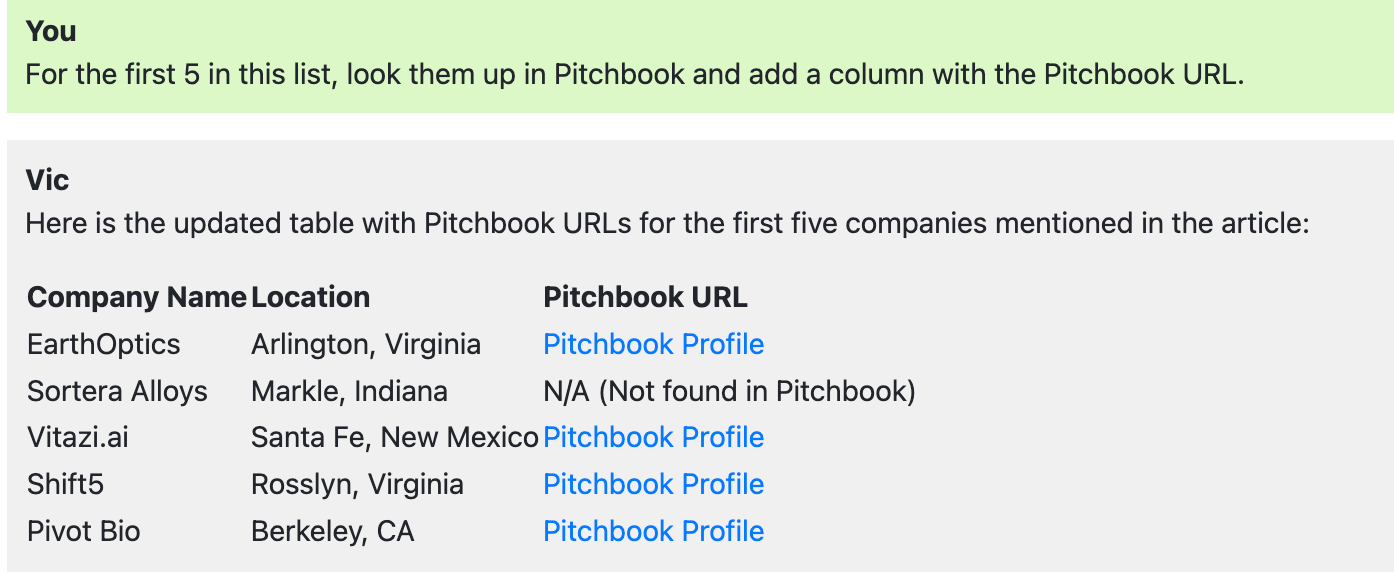

Then we can ask Vic to find those companies on Pitchbook.

Then we can ask Vic to find those companies on Pitchbook.

Notice how we can also ask it to add a column with the link to the profile. We could have asked for the website as well or other data on hand in Pitchbook. Because we’ve created a way for ChatGPT to both read and write company records in our CRM, we can ask it to see who of the companies that are on Pitchbook are already in our CRM.

Notice how we can also ask it to add a column with the link to the profile. We could have asked for the website as well or other data on hand in Pitchbook. Because we’ve created a way for ChatGPT to both read and write company records in our CRM, we can ask it to see who of the companies that are on Pitchbook are already in our CRM.

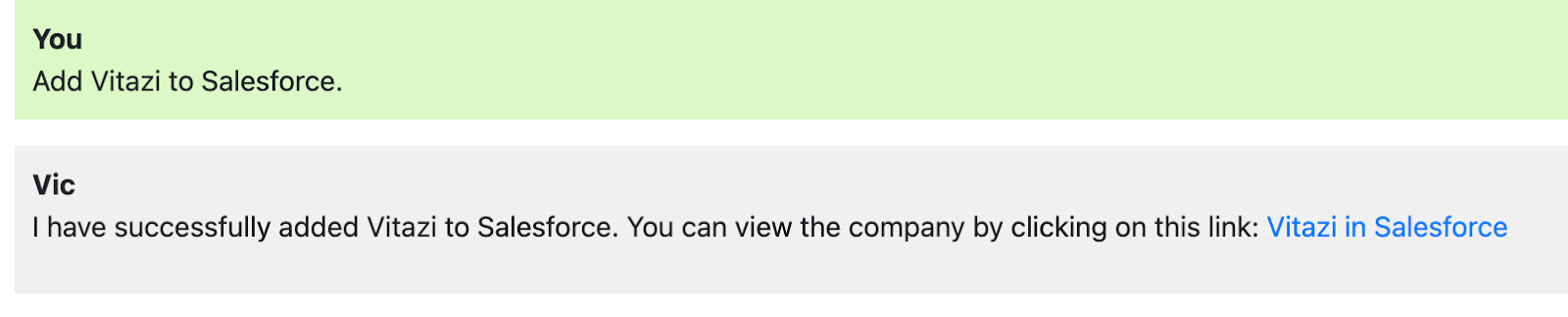

And based on that we can ask Vic to add Vitazi to Salesforce.

And based on that we can ask Vic to add Vitazi to Salesforce.

Based on this V1 “prototype” AI to support our teams by avoiding excessive or tedious data entry, we have a lot of other thoughts for this in various stages of development and deployment at Valor.

Here are a few:

- We can have Vic automatically review updates from existing dynamic Pitchbook Lists.

As new companies are being added to Pitchbook, they can be presented, reviewed and added in an easy dialog with Vic using the judgment of our investment team. - Retrieving and reviewing portfolio data.

In Salesforce, we keep track of all our portfolio company accounting data, including revenue, EBITA, cash etc. We also keep board meeting data, board notes, board decks and company updates. Combining these is how we currently write quarterly reports. It’s easy to see how Vic could be helpful with that and provide a powerful, cross-data summary. - Using Vic as a brainstorming partner.

There are many times when our teams are discussing how to best help a startup and there is a question on a fact. Looking things up in Salesforce is doable, but if you run Salesforce, you realize its reports can be a bit tedious. With Vic, we can ask questions directly and Vic can use our own data. For example, imagine making a decision and asking Vic what was a startup’s revenue in the last quarter and how does that compare to last year and last quarter? We could ask, how much runway does company Y have? Or, when did we make our first investment in Company Z? These types of important details can be accurately–and very quickly–sourced by Vic in its easy chat interface.

- Indexing all company and investment documents.

One of the critical parts of our investment process is building the right operating documents, investor rights management documents, and similar. Each startup throws off a small forest of paper. Vic can access deal docs to make answering questions about the exact terms possible a snap, like, Do we have drag along rights in the investment in company Z?

We look forward to continuing to empower our team to make great decisions in part by having the fastest possible access to the best information. Hope you enjoyed us sharing part of our platform and if you’re building similar things, let’s discuss!

Tech details:

Built with Python/Django, using Langchain, OpenAI (both the GPT-35 and GPT-4, depending on the tasks). Hosted on Heroku, secured by mandatory login with Google (only accepting domain users). Custom connection to Salesforce and Pitchbook API, integration with Carta API coming soon.

Developer: Jean Luc Vanhulst, Operating Partner

Are you looking for an cutting edge VC / AI Internship to help the development of Vic? Check out our internship page!