Quietly and efficiently, the seed round is becoming the best value in private equity.

Historically in venture capital, fund sizes $100 million and below post the greatest returns for investors. These used to be almost invariable “first check writing” funds. In a study called “Venture Capital Disrupts Itself,” consultant Cambridge Associates calculated that in venture capital’s history, some 74% of returns came from these sorts of smaller funds. In the last five years, that lucrative landscape has shifted.

There are three big reasons why seed rounds are even more compelling.

1. Venture capital seed rounds are now less competitive than later rounds.

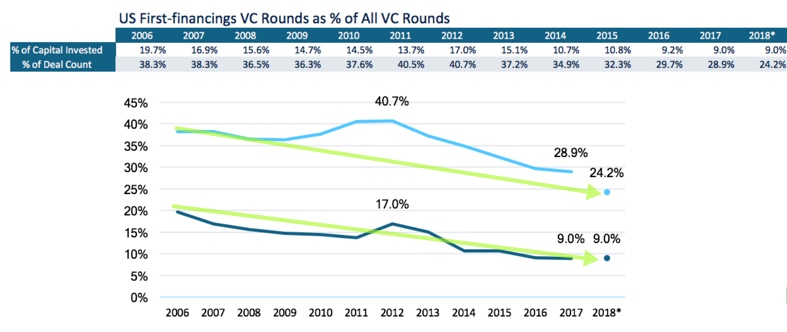

First institutional checks are just 9% of all new VC dollars invested. That’s new.

A lot of capital has recently been raised for growth rounds. So much so that now, 91% of venture capital dollars raised are in follow-on strategies to seed stage investors. Less than 10% of venture capital “capital” is deployed in round sizes under $5 million–and that’s fresh.

That means founders who need financing to support their innovation are having a tougher time. There are fewer investors doing these deals than there used to be. This makes the seed stage less competitive–perhaps less competitive than ever before.

2. Venture capital seed rounds have more opportunity for mark-up than ever before.

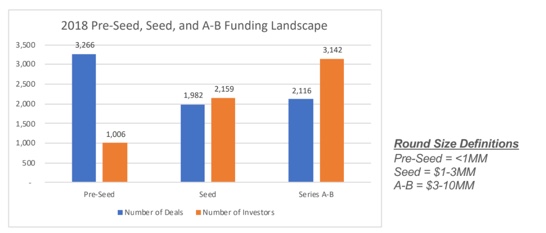

More funds are pointed at seed-stage startups for dealflow than any other stage. Sure, you say, that makes sense. You’re thinking about the huge private equity overhang, and the jump in latter stage VC funds in the last few years. That matters, and also, the capital “overhang” starts much earlier than you may think.

For example, there are 1000 more Series A/B firms than seed firms, according to a recent analysis done by Gale Bowman at Irish Angels based on Pitchbook data. 1000 more is a LOT given the transaction volume of A rounds. With the decrease in the number of seed stage transactions in the last few years, the pressure is on Series A/B firms, often called “early-stage venture capital.” The average deal valuation rose an average of 36% at the A/B level in the last year, according to Pitchbook Q1 2019 Venture Monitor. Imagine how much more your investment has to perform if you’re paying up that much just to get in… This makes Seed stage venture capital not only less competitive but potentially more lucrative.

3. Venture capital seed round transaction growth is not Silicon-Valley-centric.

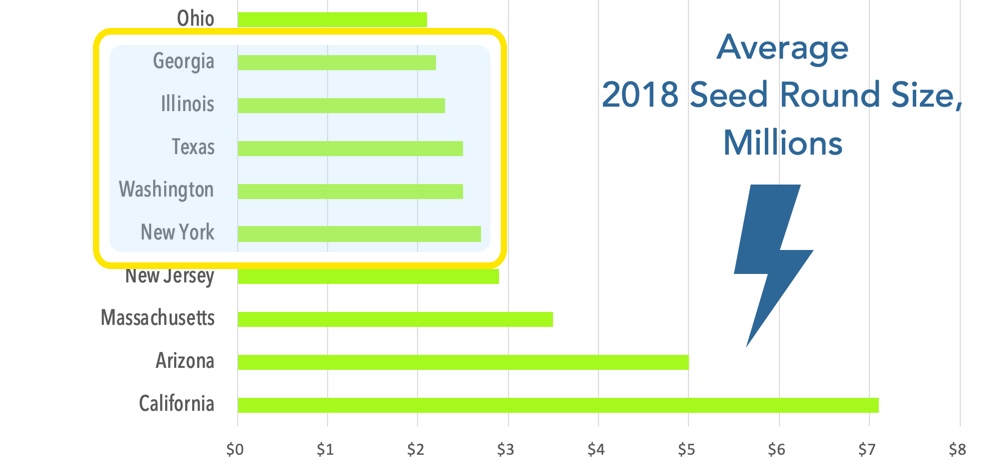

Several states are outperforming the national average in deploying seed capital. Though there were fewer seed rounds since 2014, the seed rounds we logged were larger. As a result, gross seed dollars deployed increased by 567% over this time period. We found Georgia, where we are headquartered, Virginia, Utah, Florida, Maryland, and Arizona are increasing the pace of the number of seed transactions most aggressively.

Several states are outperforming the national average in deploying seed capital. Though there were fewer seed rounds since 2014, the seed rounds we logged were larger. As a result, gross seed dollars deployed increased by 567% over this time period. We found Georgia, where we are headquartered, Virginia, Utah, Florida, Maryland, and Arizona are increasing the pace of the number of seed transactions most aggressively.

Moving from transaction volume to dollars deployed, Ohio, Delaware and Arizona stand out alongside California as growing muscle in putting capital to work. When you look at the trend, states like Georgia and Maryland have strong seed capital dollar deployment growth almost on par with California in terms of acceleration.

A new cycle in venture capital has emerged. The majority of VC firms have abandoned the first institutional check. Doors are open for new strategies, such as Valor’s, to maintain the high level of venture capital risk and reward investors rely on VC for. Also, investors who are writing the same venture capital allocation check to much larger fund sizes should be aware that moving up the capital stack may depress the returns they associate with venture capital.

Questions such investors should be asking include:

• How are they going to maintain exposure to the most rewarding side of venture capital?

• When does venture capital become PE?

• If an investor continues to put money into later stage strategies in the current market, at which point does the “ball stop” because there are not enough seed transactions to renew the deal pipeline upstream?

Seed venture rounds are more attractive than ever.

Investors who remain compelled by investing in first institutional capital stand to be rewarded in the current cycle and the near future, as it has become less competitive, but no less rewarding. Want to “geek out” with us on seed round modeling? Poke around Valor’s 8-year interactive Venture Capital Seed Round data model.