As a leading Southeast venture capital firm, Valor has daily conversations with capital partners on finding value. We’re headquartered in Atlanta and most of our portfolio is located in the Southeast. Our new Fund 2 specifically invests in this region. We’re an outlier and our limited partners have unique vision—however, most capital partners choose the big, more competitive piles of venture capital operating out of the US venture hubs around San Francisco, Boston and New York.

One of the most interesting reports to come out recently brings to light the potential downsides of the traditional approach.

It turns out in venture capital as in life, investing in the biggest may not mean the best.

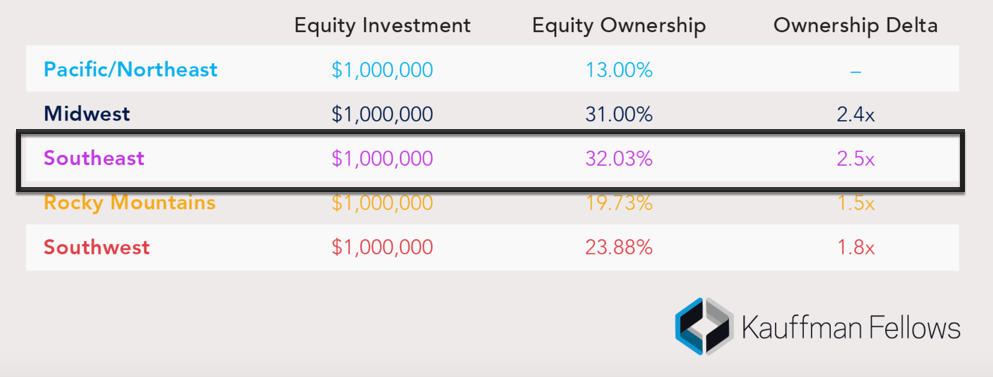

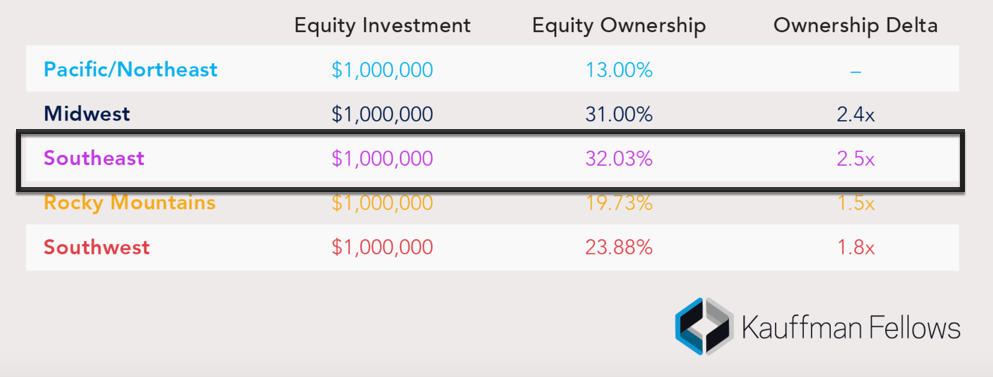

Kauffman Fellows used the Clarafai open API to review 90,000 venture-backed startups in the United States between the years 2000-2018. It found that valuations outside of these venture hubs are 13–32% lower, “meaning that VCs can invest the same dollars into startups for larger equity stakes, thus having a lower bar at exit to achieve strong realized multiples (RMs).” In fact, “compared to the Pacific and Northeast, a venture dollar in the Southeast results in 2.5x more equity ownership for the venture capitalists,” the authors write.

Here’s how that translates into value with a hypothetical $1,000,000 seed investment.

Southeast Venture Capital 2.5X Greater Realized Multiple – Kauffman Fellows March 2020

Timely for local foundations, pension funds, and family offices

Around 21% of U.S. Gross Domestic Product (GDP) is driven by venture-capital-backed businesses. While venture is a small industry that is relatively unseen for the average citizen, the truth is local venture capital has an outsize impact on state and local economies.

“More venture investment across the country would strengthen the national economy,” according to the Kauffman report. In light of the economic blows dealt by the novel coronavirus, now may be the perfect time for leading investors to rethink their capital allocation strategies and find better-realized multiples, as well as play stronger roles revitalizing their local economies, by investing in places like the Southeast.