Markups–when one investment firm invests after another firm at a higher price–are given a lot of weight in venture capital.

More markups are supposed to mean more funding, and so they are used as a proxy for successful firms. The industry is arranged around this notion, with the largest set of markup tracking, the Cambridge Venture Capital Index, choosing to separate “better” VC firms from others by quartile based on their markups in addition to hard numbers such as realized multiples.

Increasing the popularity of markups, VCs want to showcase how their portfolio gains value, so markups are used as an intermediate measure of success on the road to realized venture capital returns.

We decided to ask, are markups a driver of venture capital returns or an uncorrelated phenomenon of very active venture?

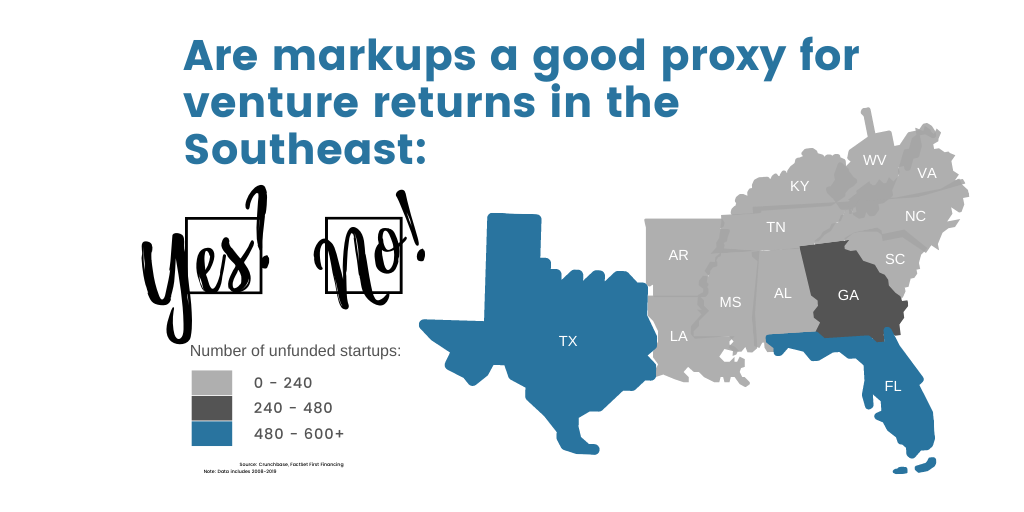

Working out of our headquarters in Atlanta with a track record across our general partners of 50+ investments in the region, we were curious to discover if Southeast firms get fewer markups on tech startups. Are markups correlated with exit multiple? Are markups really a fair proxy for venture capital investment returns?

Our analyst Rodney Morris, a finance grad from Morehouse who interned at the Federal Reserve before joining Valor, led a team including Yumi Rivas and Daniel Hagdu to dive in. Their paper explores the answers to these questions.

Key findings on venture capital returns and region

This research has two significant conclusions:

- Markups are a phenomenon driven by access to capital, not startup business merit.

- 1 in 4 startups in the Southeast only need one round before exiting, which is 10x more efficient than typical West Coast startups.

From our findings, we have determined that markups are not an accurate proxy for the value of a venture capital investment in a startup, at least in the Southeast.

Our research also reveals that startups in the West Coast region have more markups than startups in the Southeast do, and that appears to be driven more through robust early-stage funding opportunities rather than venture return. In fact, even without markups, startup investments in the Southeast, while more rare, return slightly more capital to investors and are more capital efficient.

This conclusion flies in the face of the long-held bias that West Coast investments create a de facto premium return opportunity. The facts around regional venture returns and markups are quite a bit more nuanced.