I’m looking forward to speaking in a few weeks for Atlanta Technology Angels and for the Alpharetta CEO Forum. It’s fourth quarter, so both groups want to know more about where investments are going in 2019 and landscape shifts pertinent to them as executives, leaders, and angel investors. I think they’re brilliant to take a keen interest.

Based on the third quarter just in our portfolio at ValorVC, we’re in the midst of a wild time of innovation. Across the portfolio, every single company grew topline revenue while also releasing a new innovation within their solution and attracting significant new customers. We invest in hypergrowth software, and hypergrowth is just what we got.

It makes sense. The business of innovation is the single biggest driver of sustainable tech jobs and economic development, not to mention the driver of solutions to civilization’s problems. What’s going on in venture capital has ramifications far beyond the size of our nichey little industry, which only employes a few thousand people worldwide.

Here’s the buried headline in VC: the big returns game is playing on the smallest field.

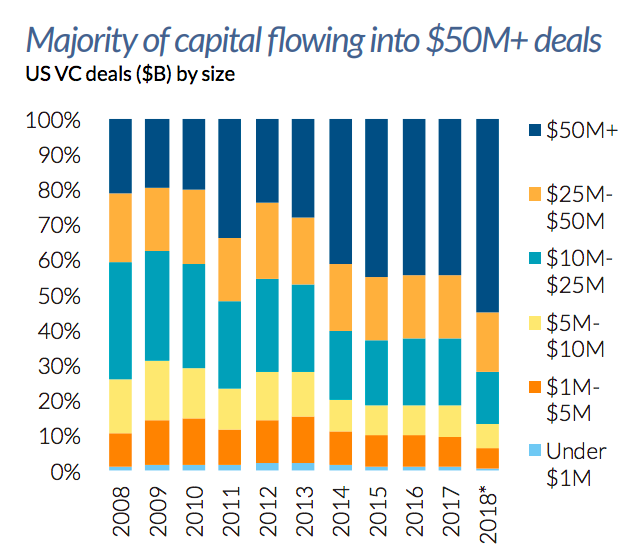

Few have noticed the following facts. We’re on pace to hit $100 billion invested in the U.S. this year. However, that’s sadly misleading as an indicator of funding new innovation. Most VC money is now in round sizes over $50 million, as you can see from this Pitchbook chart.

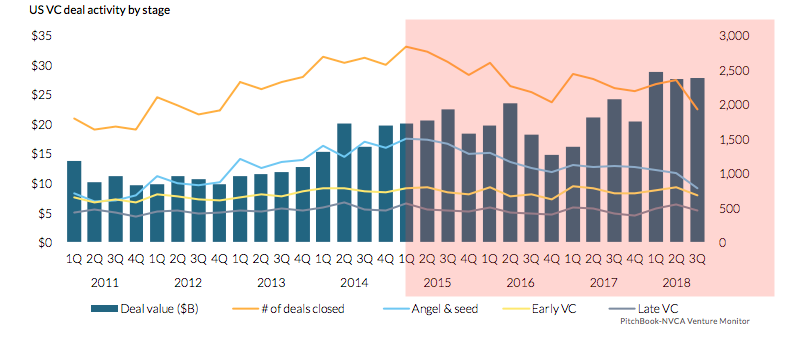

Companies taking $50 million+ rounds aren’t classic startups. The total number of companies getting first rounds declined for the 5th straight quarter in Q3. (You can see the slippery slope of seed stage in the following bar graph.) Overall, early investments are down another 20% this year over last year. All these big funds and all the growth in VC is resulting in now 3 years of fewer and fewer deals done period–check out the yellow “deals closed line” below, shaded in red. Does that make sense to you?

ValorVC loves this

As the valuations go up and up, with 40% of venture funds raised this last year over $100 million, we’re focused on small deals and big ideas–transformational software that can disrupt a major industry. Where the new sexy in VC has slogans like bigger is better, we believe fund size should suit strategy. Assets Under Management (AUM) are an outcome, not a business plan for an investment management firm.

While most VCs plan to invest with less risk by moving up, and up, market, we remember to get the historically high returns associated with early-stage companies, you have to have take on –and manage– risk. One of the risks faced by “fat strategies” is that the bar for acquisition–the most typical path for partners to make money–hasn’t budged nearly as much as the valuation on early stage deals. Most corporates still prefer their acquisition check under $500 million. That’s going to depress returns in all but early stage venture. While most funds are rallying to later stage deals, investments in building ideas that are a decade old, we’re looking for the brilliant entrepreneurs who aren’t satisfied with the current state of innovation. We see huge opportunities in our extremely fractured economy for entrepreneurs with fresh software solutions now. These ideas are all contrarian in the current late-stage venture capital craze.

The types of deals Valor invests in–first equity financings–are the most underserved and also historically most lucrative side of the market. We’re watching these trends closely and using them to inform how we invest and take advantage of “abandonment of the field” in seed stage. While our team is thoughtfully speaking with partners and potential partners, one thing we are certain about is this: we will continue to invest in first financings for phenomenal software companies with compelling teams who are building real-world innovation outside of Silicon Valley.