I met ten new entrepreneurs this week, five at The Gathering Spot in Atlanta and five at Capital Factory in Austin. The companies were radically different–from healthcare, to communication, to a market place software. A couple were white guys, but for the most part I met with minority entrepreneurs. Despite all this diversity, all of them wanted between $1.5M and $3M from the most well known VC they could attract.

The conversations on how much they wanted was practiced and easy–and if they could have just heard each other, it was like listening to tape recordings.

What can you get for 25% that you really want?

My surprise was that the conversation on what they would do with that money was a lot less in focus. “Spending it on marketing and sales” was the general theme, but as for how–not one had a burning plan. No one had picked a CRO or that next key hire. Most want “digital marketing” but aren’t super sure what kind or which platform or . . . Those are recipes for burning equity via Adwords.

This is a little like a fashionista who just must go to mall. Or insisting on having the most expensive new designer shoes at Saks, without even a specific party to go to. It doesn’t make sense, but people do it. It’s possible your early VCs don’t want to get too specific at this stage because you might realize you need less money than you think.

I spent much of my conversations this week trying to understand that urge to be part of the typical VC program better. I suggested alternatives to some of the entrepreneurs who already had great customers, beautiful vision, and a joy in their journey. Because what more do they really need?

Seeking validation

I suspect validation. Being an entrepreneur is lonely. It is possibly less lonely that it used to be with accelerators, co-working spaces and the like, but the downside of this togetherness is creating an entrepreneurial financial follow-me culture. The allure of having the public approval of “the system” through a financing is a lot like the way some people dream about their weddings. But if you’ve had a wedding, or a financing, you know the party is short. The reality of the daily grind is where you live. What makes a good marriage, or a good VC relationship (which often lasts longer than the 8 years of the average American marriage by the way), is a day to day that makes sense and supports your dreams.

Validation-busters

You can mitigate your natural need for outside validation by taking a serious look at some of your realities.

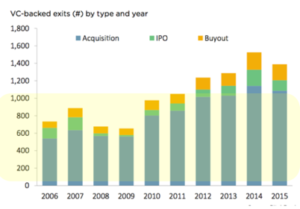

- How big is your exit going to be? Most software companies are acquired; most never IPO.

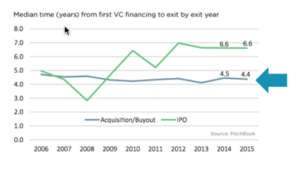

2. How big can you get in 4-5 years?It’s probably not talked about enough how long it takes to grow a software startup to exit. The corporate exit/acquisition average is 4-5 years, and it’s pretty stable.

2. How big can you get in 4-5 years?It’s probably not talked about enough how long it takes to grow a software startup to exit. The corporate exit/acquisition average is 4-5 years, and it’s pretty stable. 3. How much are you going to get for your company in ~ 4 years?

3. How much are you going to get for your company in ~ 4 years?

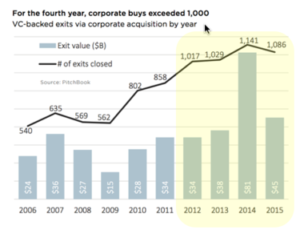

Do the math on the VC deal you’re taking, including liquidation preferences and other built in gotchas. How much of that exit will be yours? The price corporations are paying for software is falling. Creating software is becoming more of a global commodity.

Do the math on the VC deal you’re taking, including liquidation preferences and other built in gotchas. How much of that exit will be yours? The price corporations are paying for software is falling. Creating software is becoming more of a global commodity.

Creative fire

What is never a commodity is your creative vision and fire. Don’t sell it short. Parting with 25% of your company may be the right decision if that’s the capital you truly need in the next 12-18 months to build your vision–but it also may just be following the crowd to matching articles in Tech Crunch and VentureBeat that never get you a single customer or the sense of accomplishment in doing it your way. Be sure. You can’t ever get it back.