Investing in Atlanta vs. the Market

Is a dollar invested in Atlanta companies going further for investors or not?

Valor Ventures is headquartered in Atlanta. We invest nationally in hyper growth software companies. We see first-hand the compelling value of Atlanta startups and have made investments in two in just the last four months, Rented and Smart Commerce. We began to wonder how the returns of Atlanta-based companies compare to the broader market and also curious about how top private investors are sending capital into the Southeast.

Many of the world’s top companies call Atlanta home. Everyone knows the big players, Coca-Cola, Home Depot, and the like, but when you look further there is a thriving ecosystem of mid and small cap companies in the Greater Atlanta area such as Mohawk Industries, Manhattan Associates, Cardlytics and many more backed by the Southeast’s private wealth. Ultimately, we wanted to answer the question — which would be a better investment? The S&P 500 index? The Russell 2000? Or a theoretical index of Atlanta-based companies?

Investing in Atlanta: The Methodology

We looked at the pricing data in 20, 10, and 5-year increments. The sample size of companies was 42 in 1998, 58 in 2008, and 64 in 2018. If an Atlanta company was trading in 1998 but was delisted at any point it was excluded. If, for example, a company went public in 2010, it was included in the 5-year return calculations. The theoretical ATL index is a price-weighted index. This simply means that we summed the prices and divided by the number of companies.

Index ATL: The Findings

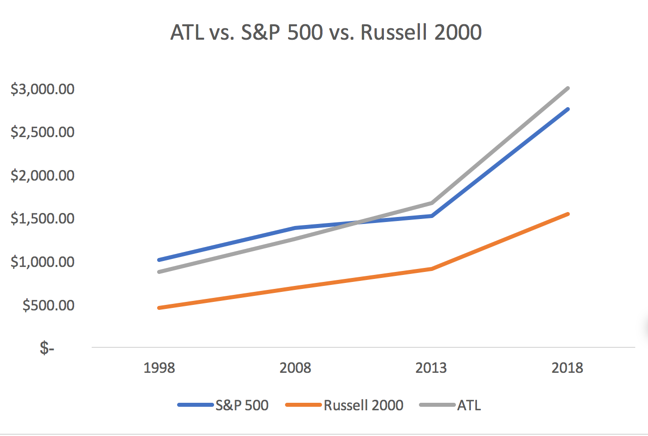

The chart illustrates the price levels of each index through time. Although you can get a sense of the returns judging by the slope of each index we are interested in the percentage returns.

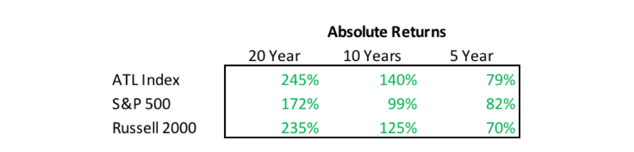

Above represents the absolute returns of the indexes over each time interval. Obviously, it makes sense that the returns are smaller over a shorter period of time.

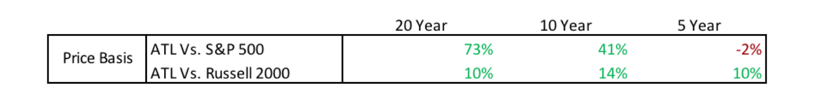

On an absolute return basis, investing in Atlanta companies outperformed both the S&P 500 and Russell 2000 by a wide margin.

- $100,000 invested in the S&P 500 back in 1998 would today be worth $272,380.

- That same investment would be worth $344,890 in an Atlanta index.

Over the past twenty years investing in Atlanta has generated exceptional returns for investors. We at Valor think the next 20 years will bring much of the same. It’s a good time to invest in Atlanta.

** Room for further research:

This analysis did not adjust for stock splits, which do have an effect in the calculation of a price-weighted index. Additionally, the S&P 500 is a value-weighted index so comparing a price index to it is not exactly an apples-to-apples comparison more of a food-for-thought.

-Matt Gates, Junior Analyst