Atlanta is one of the world’s leading fintech hubs. Recent exits, like Kabbage’s to American Express, and IPOs, like Cardlytics, have heated innovation from simmer to sizzle. There’s a pattern that many of the most innovative fintech companies are launched in our backyard, says, Valor General Parter Robin Bienfait.

“I have the honor to engage with some of the best and brightest technology leaders from Samsung, Wells Fargo, Mastercard, along with my role as an Independent Director on MUFG, Putnam Investments, Empower Retirement and GW Life Co. I regularly advise and connect business with fintech innovation. This is an exciting space for me as corporations are seeking ways to engage with new capabilities,” she says.

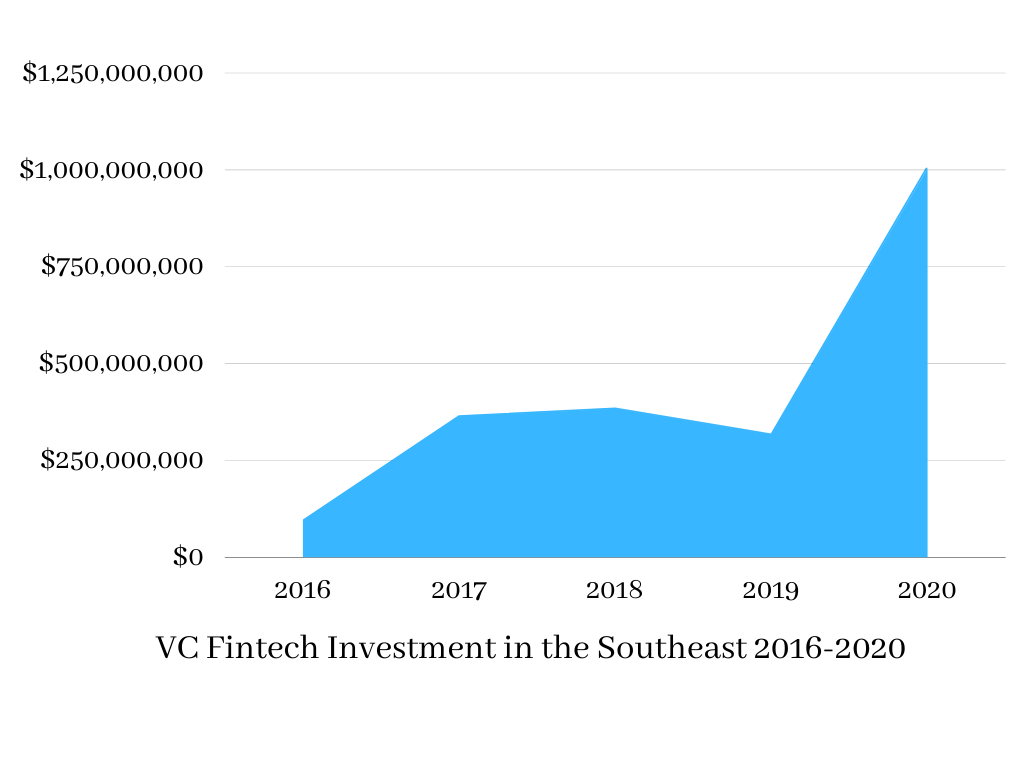

Over $1B Invested in Fintech Startups In the Last Year

More than $2.1B has been invested in fintech in the Southeast over the last 5 years –but get this. A full $1B of it was invested just in the last year. Taken together, the Valor portfolio is responsible for almost $100 million of it. Props to George Azih with LeaseQuery, Jennifer with SmartCommerce, Sheena Allen at Capway, for driving the lions share of that.

Valor’s fintech portfolio features leaders tackling top challenges like smarter better product discovery, credit risk scoring, better background screening, more efficient loan analysis, bias-free banking, and complex accounting challenges. This means founders at our portfolio firms like Drum, Funding U, LeaseQuery, Capway, Vital4 are calling the action from the front lines, fueled by a regional economy that knows fintech better than any other. Over 70% of credit card payment processing flows through Atlanta, and that’s just one leaf on the tree. The headquarters of fintech giants like Intercontinental Exchange, Fiserv, Equifax, FIS Global, Global Payments, and NCR are trunks that have proven to grow strong branches like Greenlight, Bakkt and Bitpay.

Valor’s fintech portfolio features leaders tackling top challenges like smarter better product discovery, credit risk scoring, better background screening, more efficient loan analysis, bias-free banking, and complex accounting challenges. This means founders at our portfolio firms like Drum, Funding U, LeaseQuery, Capway, Vital4 are calling the action from the front lines, fueled by a regional economy that knows fintech better than any other. Over 70% of credit card payment processing flows through Atlanta, and that’s just one leaf on the tree. The headquarters of fintech giants like Intercontinental Exchange, Fiserv, Equifax, FIS Global, Global Payments, and NCR are trunks that have proven to grow strong branches like Greenlight, Bakkt and Bitpay.

Valor General Partner Peat led his first fintech investment in Atlanta in the 90s–SecureTax, acquired by Intuit. He says, “Atlanta has had a cluster of fintech startups going back to being the headquarters of credit card processing in the late 1980s, even before that in banking software. What followed has been hundreds and hundreds of venture-backed fintech startups that have seen their tens-of-millions of dollars exit values, hundreds of millions of dollars in exit values, billion dollar exits, and multi-billion dollar IPOs. Atlanta is starting to build a better ecosystem of seed-stage institutional VCs. Valor Venture’s institutional second fund is one good example of progress with multiple fintech startups in Atlanta in the Valor Fund 2 portfolio already.”

Over the last 5 years, 290 fintech startups have been launched in the Southeast according to Crunchbase.

Just the top 10% of these already creates a significant pool of opportunity for the region and the region’s investors. Trends Valor sees as key in our portfolio and pipeline include:

- Inclusion – most fintech has been built by founders with white privilege for cultures of privilege. Fintech of the future will be built with “inclusion inside.” Examples of this theme in Valor’s portfolio include Robinhood, and Valor portfolio firms Drum, founded by the same team that founded Kabbage, and Capway, a digital bank tuned to the Millennial generation.

- Intelligence – in the past, the move that made fintech famous was handling large amounts of data with a semblance of speed. Today, the power move is correlating data to create a more intelligent organization that makes smarter decisions “automatically.” Examples of this theme include Expensify and Bettermint; in Valor’s portfolio, think of Vital4, LeaseQuery and Funding U.

- Mobile might – in the past, a lot of fintech had a certain centrality created by compute power and regulation. Today, a major theme in fintech coming s putting transaction power in the hands of the end user. Examples from Valor’s portfolio include SmartCommerce, which empowers CPG brands to sell anywhere; Goodfynd, which empowers food trucks to sell more across channels, and Capway, which empowers underbanked to access the full power of their financial opportunities in moments.

Meet Top Fintech Startups at Valor’s Fintech Frontiers Seminar in April

Our upcoming Fintech Frontiers event in April pairs powerful corporate innovation leaders like Equifax and Truist with founder visionaries to share takeaways from both sides of the table. Inquire to see if you qualify for an invitation to these private, CEO/founder-led sessions. More broadly, if you’re deepening your network in Fintech, consider attending Atlanta Tech Park’s Cyber Fintech Conference.