Venture-Backed Firms Find More Exits

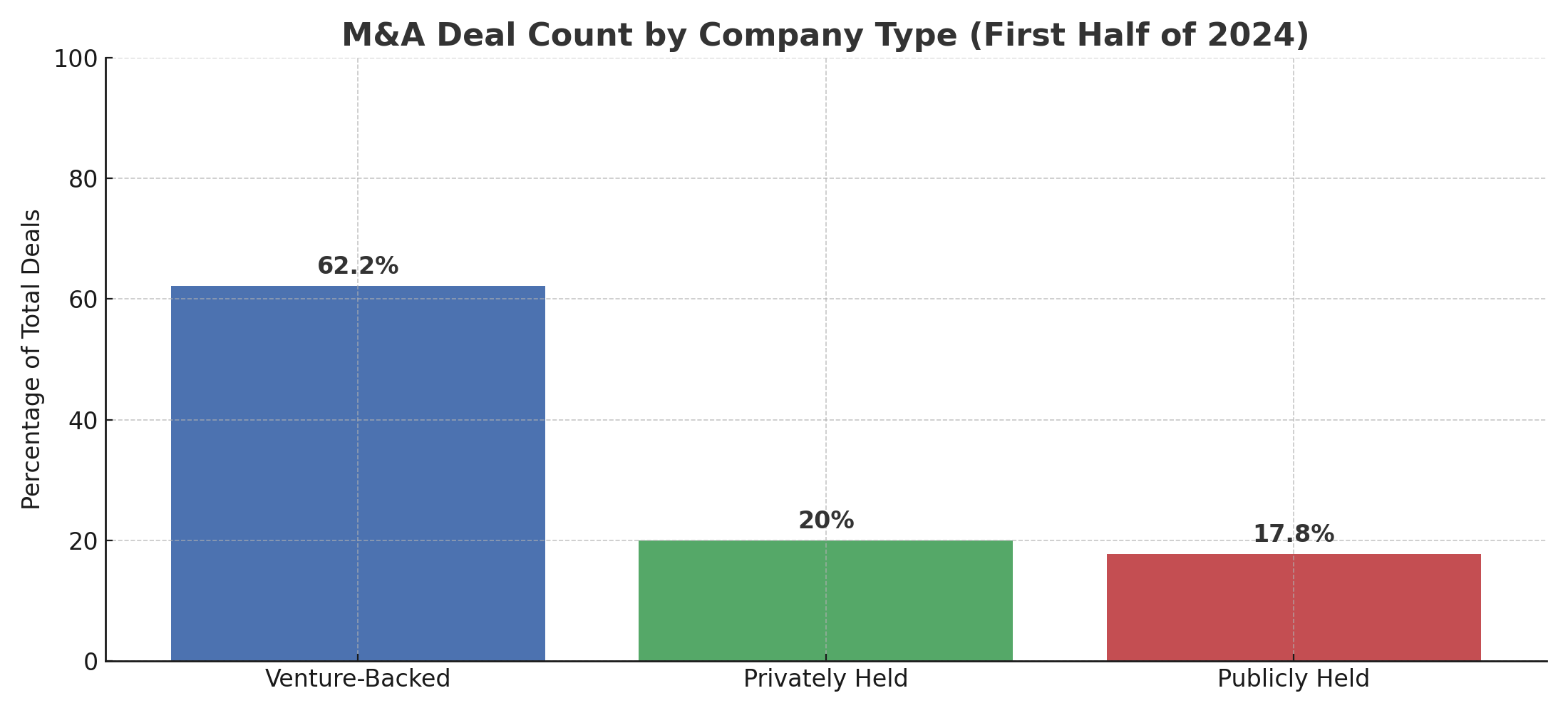

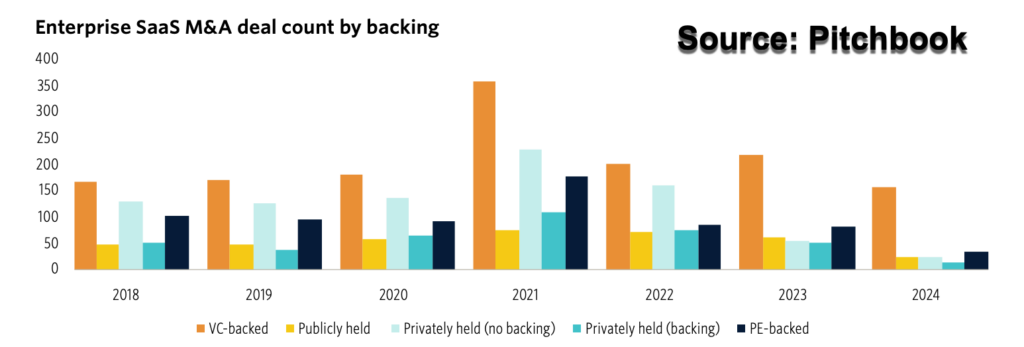

In the latest Enterprise SaaS M&A Quarterly Update from PitchBook (Q3 2024), one insight stands out above the rest: venture-backed companies are leading the way in mergers and acquisitions. In the first half of 2024, the majority of enterprise SaaS M&A transactions—a remarkable 62.2%—involved venture-backed firms. This is a shift from the historical average of roughly 38% for these types of acquisitions, underscoring the evolving importance of venture capital (VC) in the overall M&A landscape.

Venture Capital’s Dominance in Deal Count

Venture Capital’s Dominance in Deal Count

The numbers speak for themselves. According to PitchBook, a total of 156 deals involved VC-backed companies this year so far, outpacing all other forms of M&A backing, such as private equity or publicly held enterprises. The chart illustrating deal count by funding type paints a clear picture: venture-backed firms are not just participating in the M&A market—they are dominating it. Some of the reasons are unique to each deal, of course, but as such a broad trend we have some opinions on what’s going on. Venture continues to professionalize–as does M&A. When you buy a venture-backed company, what the market is also buying is:

- Strong governance, including a board and standard operating docs

- Professional employment agreements

- Clear founder equity

- Dealmaking expertise “at the table” in the investors that backed the company

- A clarity that a venture-backed company was in some way “built to scale” and is signalling a certain openness to a transaction. No one likes to ‘waste their time’ knocking on the door of a privately held company that may or may not be open to an exit.

What reasons occur to you? Corporate acquirers and private equity firms are certainly showing a growing preference for venture-backed targets. VC-backed startups have already been vetted by the venture ecosystem, have a board and a governance system, and clearly give acquirers confidence in their potential for further growth.

What This Means for Founders

For founders intent on a great acquisition, they may need to consider VC, not only as a means of capital but also as a driver of access to an exit. In the last five years, privately held companies have averaged around 20-25% of M&A transactions, significantly less than the share of venture-backed deals. This means that venture-backed companies are being acquired at roughly three times the rate of privately held, non-venture-backed firms. For founders, this highlights the value of venture backing—not just in terms of funding growth but also in increasing the likelihood of a successful and lucrative exit.