Listen to "Raising a Growth Round In the Age of AI with Christy Johnson of BIP Capital" on the Atlanta Startup Podcast!

Listen to "Raising a Growth Round In the Age of AI with Christy Johnson of BIP Capital" on the Atlanta Startup Podcast!

Founders, it’s 2025, and the game has changed (again). But don’t worry—Valor's got you. You’re building something great, and you’re eyeing that elusive

Series A raise. What does it take to get there? We’ve dug into the latest data from sources including our own recent Series A graduations like FirmPilot, Aetos, and Saile; Pitchbook; fundraising surveys from other seed stage VCs in enterprise SaaS and AI; and, insights from

Peter Walker’s recent briefing to Valor on Carta data.

Let’s cut through the noise and get straight to what you need to know. (By the way, Valor leads seed rounds in companies who have a shot at getting an insanely strong Series A. Is that you? Let's talk about the path to building the best company you can.

Reach out here.)

1. The Growth Bar Just Got Higher

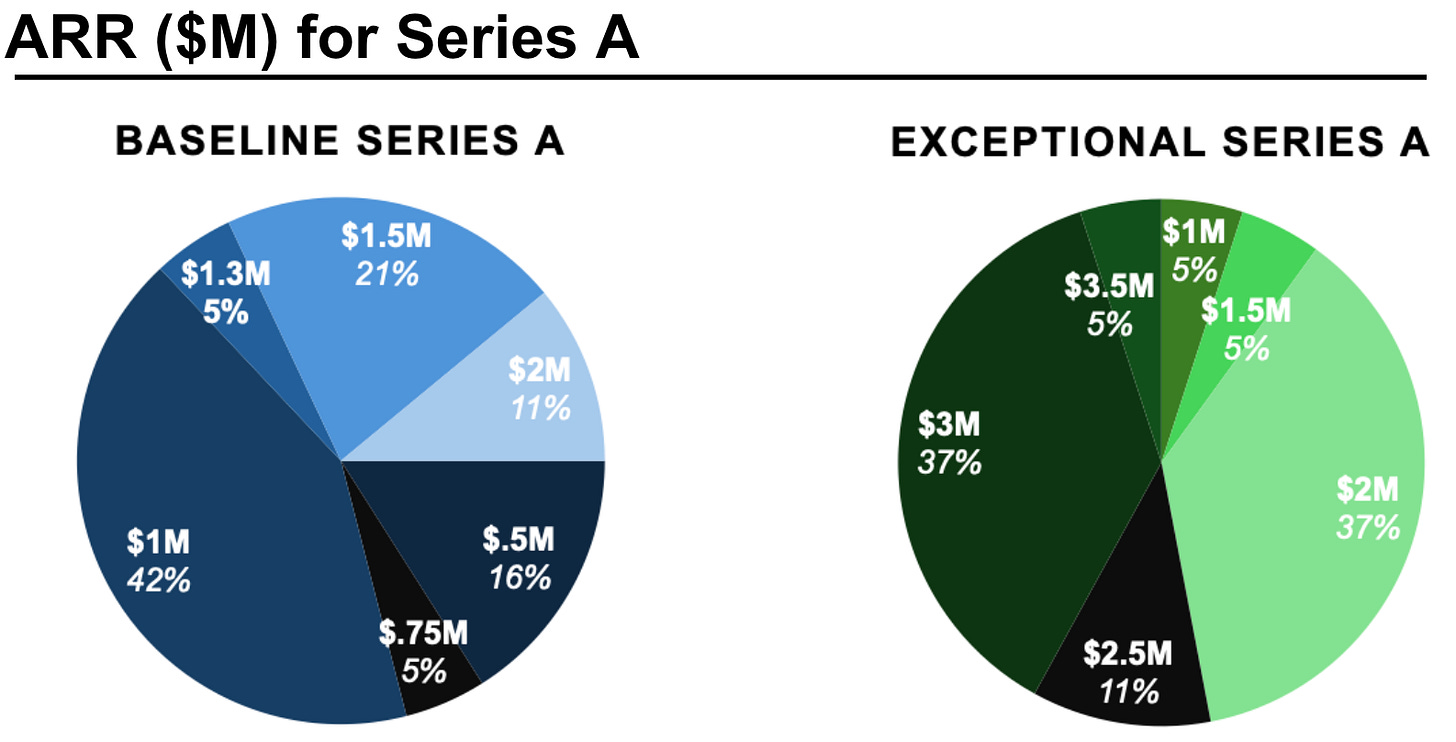

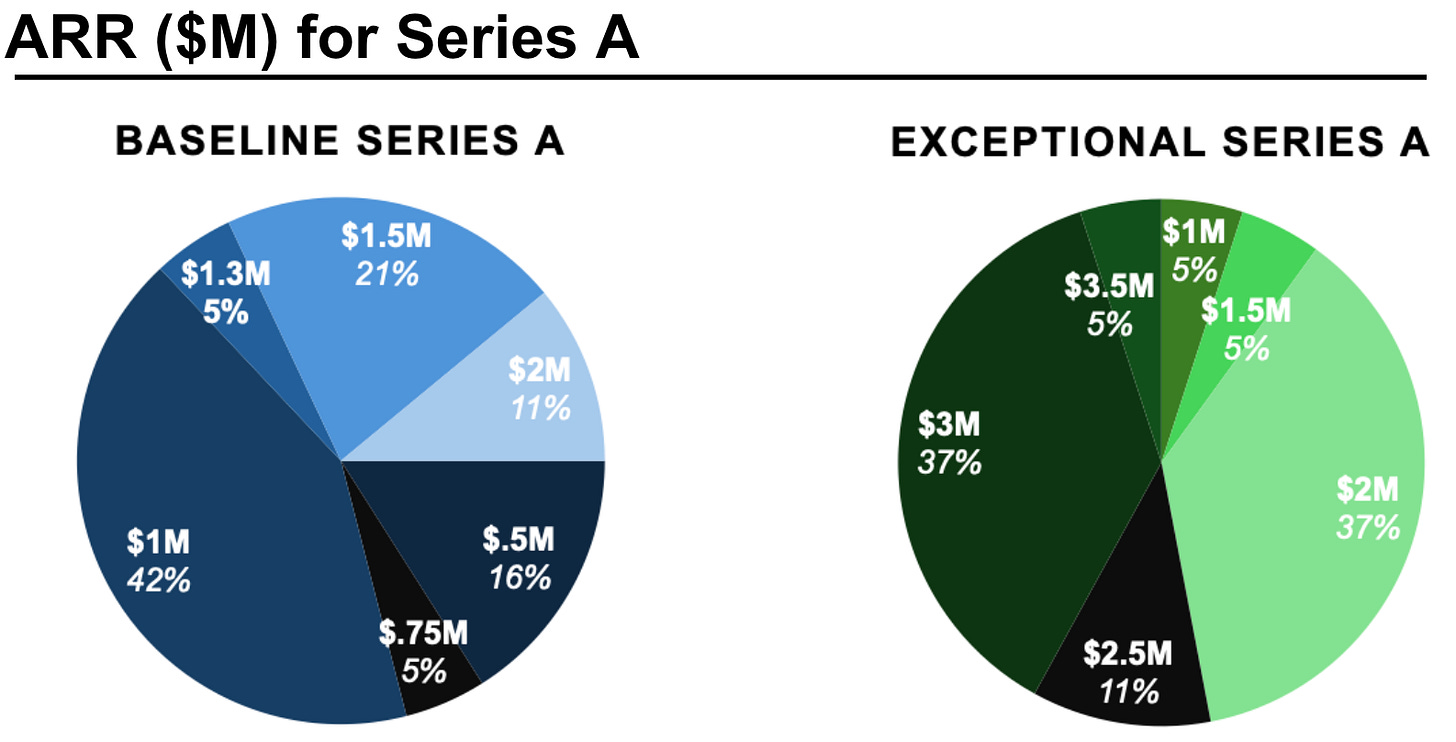

[caption id="" align="alignleft" width="1456"]

This graphic on Series A metrics is from Daniel Chesley at Workbench, a seed lead firm in the heart of Manhattan. Link to the full post.[/caption]

The days of raising a Series A on a dream, a deck, and $750K ARR are long gone. Investors are expecting real traction, and here’s what that means in numbers:

- $2M+ ARR (Annual Recurring Revenue): This is now the baseline, not the aspiration. Recent deals we’ve tracked confirm this. Yes, you can "get away" with a baseline Series A at $1M, but . . . I know you. You want the exceptional one. That starts at $2M and goes north, as you can see in the graphic from Daniel Chesley.

- 3x Year-over-Year Growth: Not just a nice-to-have—this is the expectation for a top-tier raise. Many founders have conditioned themselves to believe 80% YoY growth or 100% YoY growth is "good." The hard truth is, it is good--but it's not great enough for the Series A you want. 300%. That's the zone. It means your sales team is getting more efficient even as your ICP is getting tighter.

- Capital Efficiency Still Wins: Aim for a burn multiple (net burn/ARR) under 1.5x to stay attractive. The more below, the more attractive.

- Sales Velocity Matters: According to Workbench’s recent survey, top-performing Series A companies are signing 4-6 new deals per month at an ACV of $50K+. Yes, leave the $25K and $10K annual customers at the door as soon as you can. When you are a public company, you can go back and pick up the long tail.

2. Product-Market Fit Isn’t a Vibe—It’s a KPI

- Logo Retention Matters: Investors want to see customers stick around. Net revenue retention (NRR) above 100%is a strong signal you’re onto something. Founders who are churning 10% of your customers a month--you're dying. Refine your ICP.

- Sales Efficiency is Scrutinized: If you’re spending more on acquiring customers than you’ll ever make back, it’s a no-go. Aim for a Magic Number (new ARR / new sales & marketing spend) above 1.0. That means you sell a lot more than you pay to get those new leads. If your sales funnel is inefficient, fix it.

- Enterprise Readiness Helps: If you’ve signed a few big logos, that’s gold. Series A investors love to see a growing ACV (average contract value) and a clear move upmarket.

- Founder-Led Sales Proficiency: Valor's data indicates that successful Series A founders were actively involved in closing their first 20+ customers or first $1M ARR. You need a great proto-sales team AND you need go be able to help close the whales.

3. Southern Startups Are Having a Moment—Use It

Peter Walker’s

recent insights highlight something we at Valor have been seeing firsthand:

The South is booming.

- M&A Activity is Up: More liquidity means a stronger funding ecosystem.

- Valuations Are Strong: While the coasts cool down, smart investors are leaning into Southern startups that show capital efficiency and resilience.

- Fewer Competitors, More Talent: If you’re in Atlanta, Raleigh, or Austin, you’re in a market where capital is flowing, and top-tier talent is moving in, not out.

4. Get Your Fundraising Strategy Tight

Series A is no longer a spray-and-pray effort. This is the exact opposite of how most founders raised a seed, or what they learned in various accelerators that had them make 50 investor calls. Here’s how to optimize your process for Series A:

- Warm Intros Only: Cold emails to VCs? Might as well be sending a message in a bottle. Get warm intros from existing investors, advisors, or other founders they trust.

- Meet the Right Investors: If they haven’t done at least three Series A investments in your space in the last year, move on.

- Process > Pitching: Set a clear timeline for your fundraise and get multiple firms interested at the same time. No lone-wolf meetings.

- Proof of Upsell Motion: Workbench data showed ghag that Series A investors love seeing that at least 30% of your new ARR comes from upsells or expansions.

Final Thought: You’ve Got This

Raising a

Series A in 2025 is hard—but absolutely doable. The founders who win are the ones who:

✔

Know their numbers cold (ACV, CAC, new logo ARR, upsell/expansion revenue ARR %)

✔

Have a killer GTM strategy--efficient, focused, landing big fish at $50K plus

✔

Build Series A lead investor relationships before they need capital

So get out there, build something great, and when you’re ready to raise,

raise smart.

-Lisa Calhoun

Side note: Why is this happening? No one can say for sure, but I've got my suspicions. It's AI's fault! The most competitive startups are using AI to code, AI to help implement, AI to market . . . and that is increasing the maturity level Series A investors are looking for. AI startups are also extremely API centric, and so distribution partnerships are coming into play in a big way in this cycle. These are all topics Valor founders get mentorship on in our platform.

Photo credit: Pictured, Valor portfolio firm founder Jake Soffer, CEO at FirmPilot, whose recent "top tier" Series A after our Series Seed was led by Silicon Valley firm Bloomberg, with participation from significant strategics. He is in conversation with Kirk Somers, Valor venture partner and seasoned startup GC.

Listen to "Raising a Growth Round In the Age of AI with Christy Johnson of BIP Capital" on the Atlanta Startup Podcast!

Founders, it’s 2025, and the game has changed (again). But don’t worry—Valor's got you. You’re building something great, and you’re eyeing that elusive Series A raise. What does it take to get there? We’ve dug into the latest data from sources including our own recent Series A graduations like FirmPilot, Aetos, and Saile; Pitchbook; fundraising surveys from other seed stage VCs in enterprise SaaS and AI; and, insights from Peter Walker’s recent briefing to Valor on Carta data.

Let’s cut through the noise and get straight to what you need to know. (By the way, Valor leads seed rounds in companies who have a shot at getting an insanely strong Series A. Is that you? Let's talk about the path to building the best company you can. Reach out here.)

Listen to "Raising a Growth Round In the Age of AI with Christy Johnson of BIP Capital" on the Atlanta Startup Podcast!

Founders, it’s 2025, and the game has changed (again). But don’t worry—Valor's got you. You’re building something great, and you’re eyeing that elusive Series A raise. What does it take to get there? We’ve dug into the latest data from sources including our own recent Series A graduations like FirmPilot, Aetos, and Saile; Pitchbook; fundraising surveys from other seed stage VCs in enterprise SaaS and AI; and, insights from Peter Walker’s recent briefing to Valor on Carta data.

Let’s cut through the noise and get straight to what you need to know. (By the way, Valor leads seed rounds in companies who have a shot at getting an insanely strong Series A. Is that you? Let's talk about the path to building the best company you can. Reach out here.)

This graphic on Series A metrics is from Daniel Chesley at Workbench, a seed lead firm in the heart of Manhattan. Link to the full post.[/caption]

The days of raising a Series A on a dream, a deck, and $750K ARR are long gone. Investors are expecting real traction, and here’s what that means in numbers:

This graphic on Series A metrics is from Daniel Chesley at Workbench, a seed lead firm in the heart of Manhattan. Link to the full post.[/caption]

The days of raising a Series A on a dream, a deck, and $750K ARR are long gone. Investors are expecting real traction, and here’s what that means in numbers: