When I think about the South, private wealth isn’t the first thing I think about. I think of the wealth of home. I was raised here, with the salty smells of our barrier islands, the mayhem of Macon and Memphis, the unique chillax you find in Chattanooga, the piney woods and the deep pastures.

The South is also home to 40% of the U.S. population.

We’re the nation’s fastest-growing region per populuation. With my investor hat on, I know we are in for a stellar ride when it comes to investing in years ahead. (Not that we’ve been a bad bet in the past–much the contrary, by the numbers.)

After all, the love of entrepreneurship–like the love of baby animals, Elvis, and warm afternoons–is spread broadly across any population. We’ve got heaping helpings of people in the Southeast. Empowered people are the wellspring of wealth. Our quality of life, cost of living, and other benefits are bringing more people every day.

We also have generous private family offices, foundations and endowments.

According to Foundation Center Research, there’s easily over $200 billion invested through Southern private family offices, foundations and endowments in our region. This money comes from the number one legacy engine of innovation in the Southeast–our people. Our founders, innovators and entrepreneurs.

We take it for granted, but the beautiful buildings we have with us, the Cherry blossom festivals and rails-to-trails projects, the wildlife preserves, and the museums new and old–are the result of our private wealth right here, working.

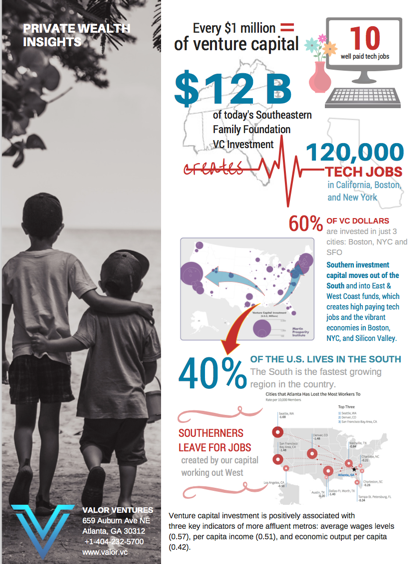

According to Cambridge Associates, a noted investment consultant to endowments and foundations, about 15% is just the right percentage of investable wealth to expose to the high-risk/high-reward strategies associated with venture capital. But being extremely conservative–because that’s Southern–let’s estimate what would happen if just 6% of this investable wealth goes to venture capital. Less than half of what’s recommended–it would be $12 billion.

What would ~$12 billion in venture capital do?

A lot. In fact, it’s one of the hidden sources of capital shaping the Southeast today, just as it did in days gone by.

What you’ll learn from this infographic is, the biggest wind driving change in the South isn’t the Gulf Stream bringing us hurricanes. It’s private wealth heading to Coastal venture capital. That breeze has unintentionally disrupted the virtuous cycle of founders empowering families who make more founders in our region.

The bad news is, we’re using our private wealth to empower other places. As rich as we are, it’s a slow drain, but a real one. The good news is, this is something we can change and I’d love to talk to you about how.