A Playbook for Founders Ready to Lead and Succeed

If you’re building an AI or B2B startup in the South, you’re stepping into one of the most exciting—and competitive—moments early-stage founders have seen. The latest data on first financings shows the terrain is evolving, and with the right moves, you can turn today’s environment into the launchpad for your next level. Here’s what you need to know.

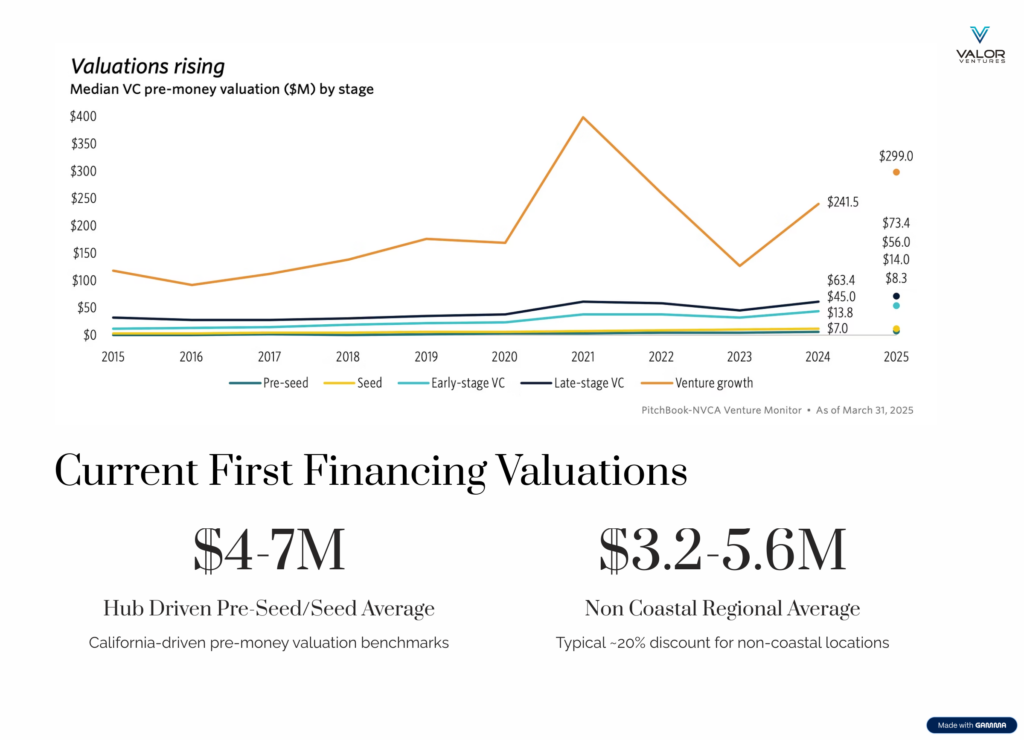

Valuations Are Focused—and That’s an Advantage for Builders

First round valuations are centering between $4M–$7M in hub markets, and $3.2M–$5.6M across the broader South. This tighter range isn’t a constraint—it’s clarity.

First round valuations are centering between $4M–$7M in hub markets, and $3.2M–$5.6M across the broader South. This tighter range isn’t a constraint—it’s clarity.

Founders who show early customer traction, revenue momentum, and a strong go-to-market motion are standing out faster. If you’re bringing growth and proof to the table—not just a vision—you’re positioned to win. Every VC deal right now rewards focus, grit, and evidence.

The Growth/GTM Story Matters More Than Ever

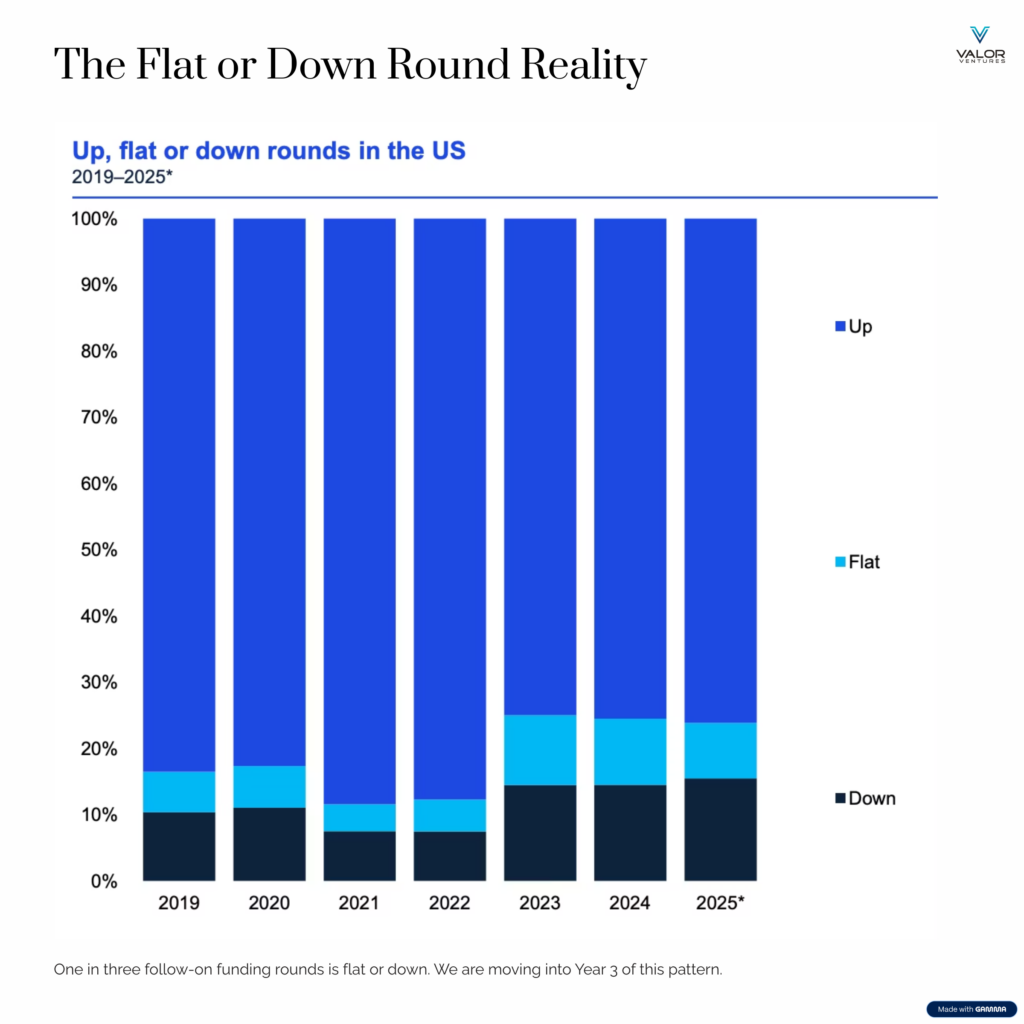

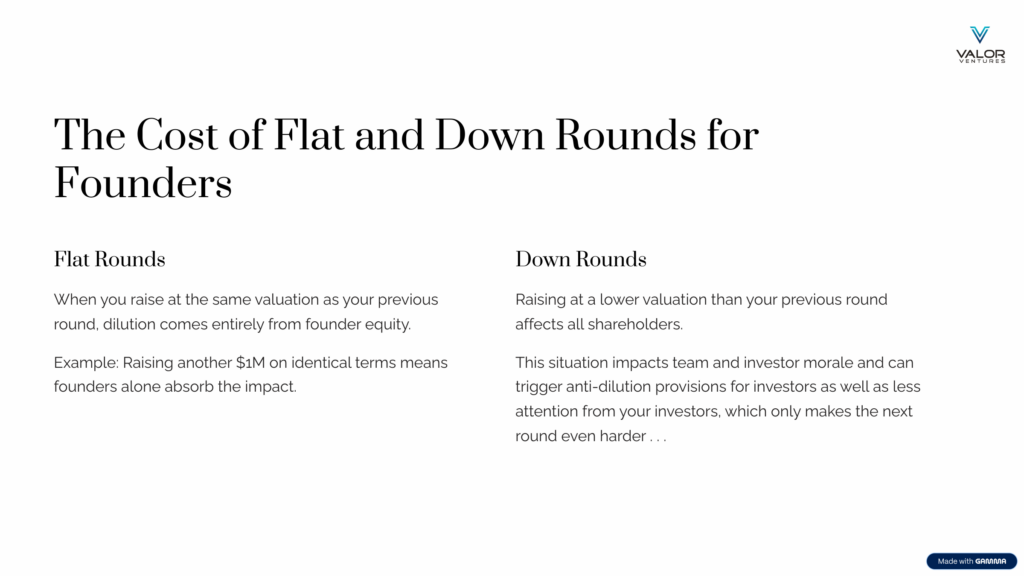

About one in three follow-on rounds today are flat or down, a trend now entering its third year. The good news? Founders who build steadily, grow intelligently, and set real traction goals early are creating undeniable momentum—and protecting their upside long-term. Getting your first valuation right isn’t about playing defense. It’s about playing smart so your next move is even stronger.

Go-to-Market Muscle Is a Game Changer

Go-to-Market Muscle Is a Game Changer

The founders gaining real traction aren’t just shipping products—they’re mastering early customer acquisition.

To position yourself for a strong first round:

•Show 10–50% growth month over month (300-500% YoY).

•Build a repeatable early sales motion—beyond founder-only selling. See Valor’s Sales Maturity Model for more on that.

This market favors action over perfection. Every conversation, every pilot, every customer milestone builds your next opportunity.

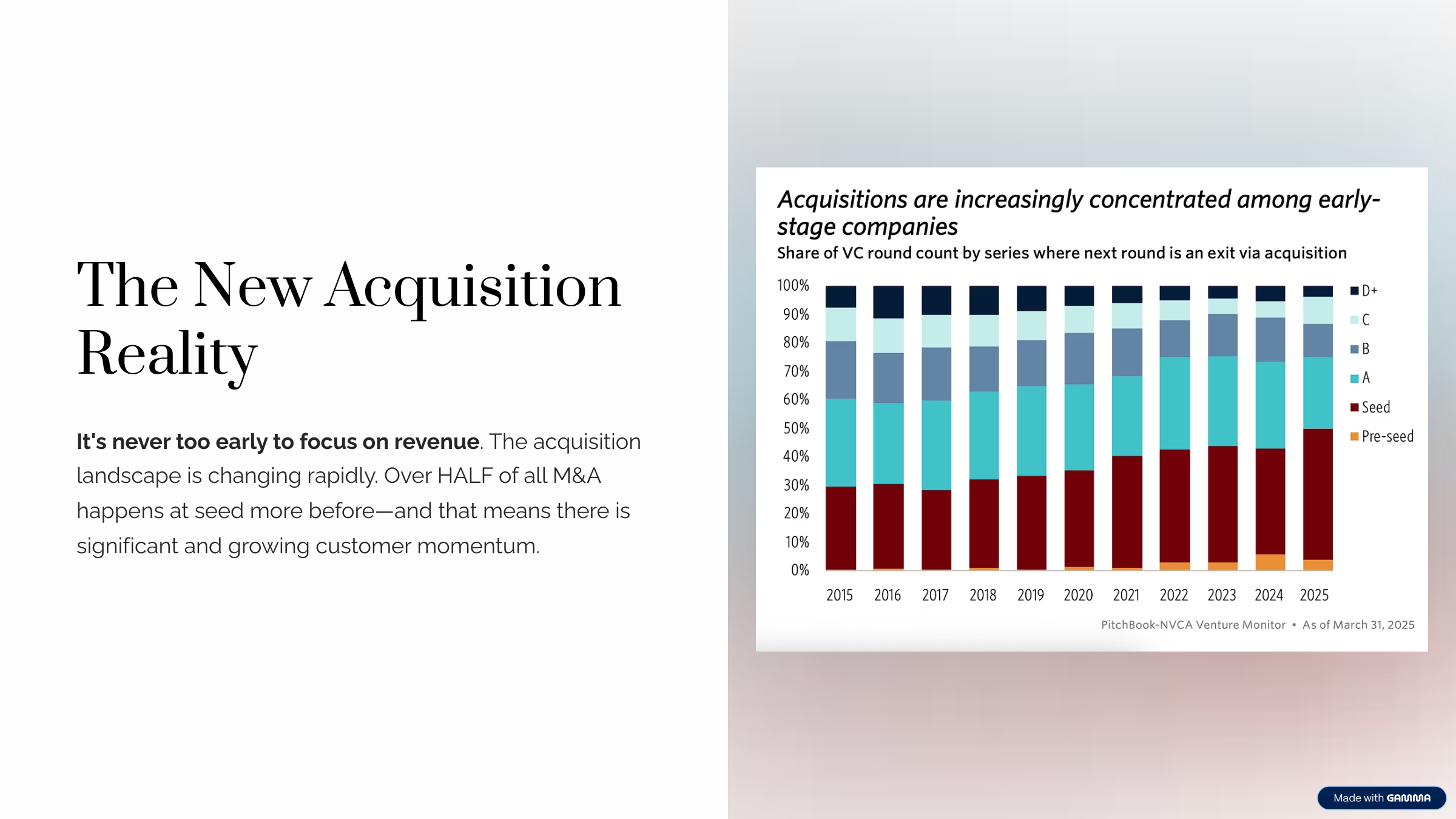

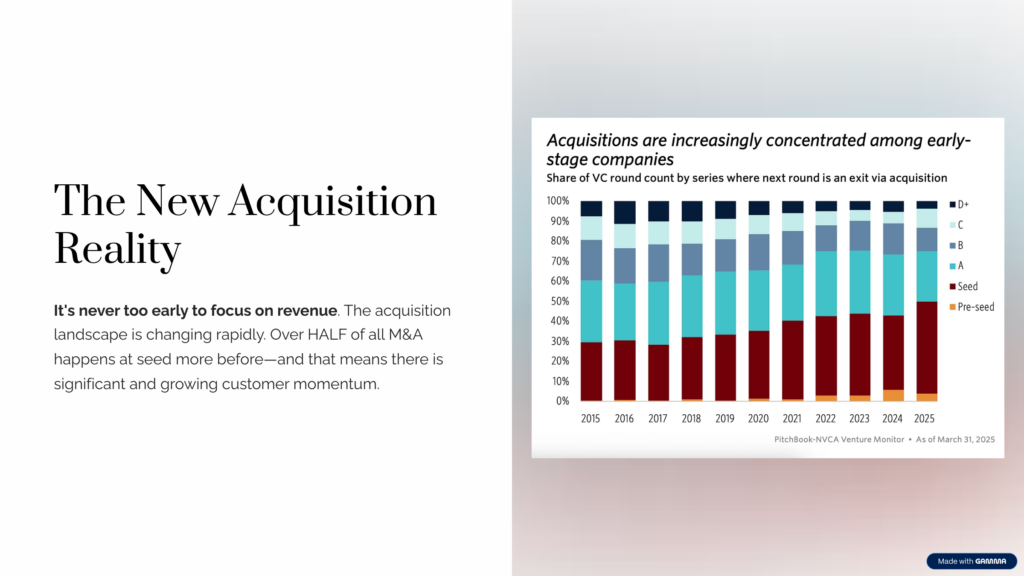

Acquisitions go earlier

Acquisitions go earlier

One of the most fascinating new developments is how many acquisitions are moving earlier in the life of a startup–at seed and even pre-seed. This is just what you’d expect from the increasing maturation of what it takes to get a first financing today. It’s a real company making moment, and acquirers are increasingly behaving accordingly.

Courageous Founders Are Leaning In—and Winning

Courageous Founders Are Leaning In—and Winning

This moment in the South belongs to founders who move with bravery and precision. The ones who aren’t just dreaming—they’re executing. They’re validating, adapting, and scaling real-world solutions that matter.

If you’re reading this, you’re probably among them–preparing to win, not just wanting to.

If you’re reading this, you’re probably among them–preparing to win, not just wanting to.

Want real, personalized insight on where you stand?

💬 Share your deck with Vic, our AI analyst, and get direct, tailored feedback on how your startup is tracking—and how to strengthen your next move.