Southern Exposure: Carta’s Head of Insights Peter Walker Shares Positive Trends in Venture Capital Unique to the South

Peter Walker, head of insights at Carta, delivered a data-rich presentation at Valor’s VC DAY, offering a founder-centric view of the venture capital landscape, with a particular focus on Southern seed stage venture capital. The insights gleaned from Carta’s vast dataset, encompassing 45,000 active U.S. cap tables and 3,000 venture funds, painted a picture of a resilient ecosystem in the South. About 24% of Carta’s data is based in the South to date, making this data set particularly rich for our region. It was a pleasure having him present at Valor’s private conference, VC DAY , for Valor LPs and founders.

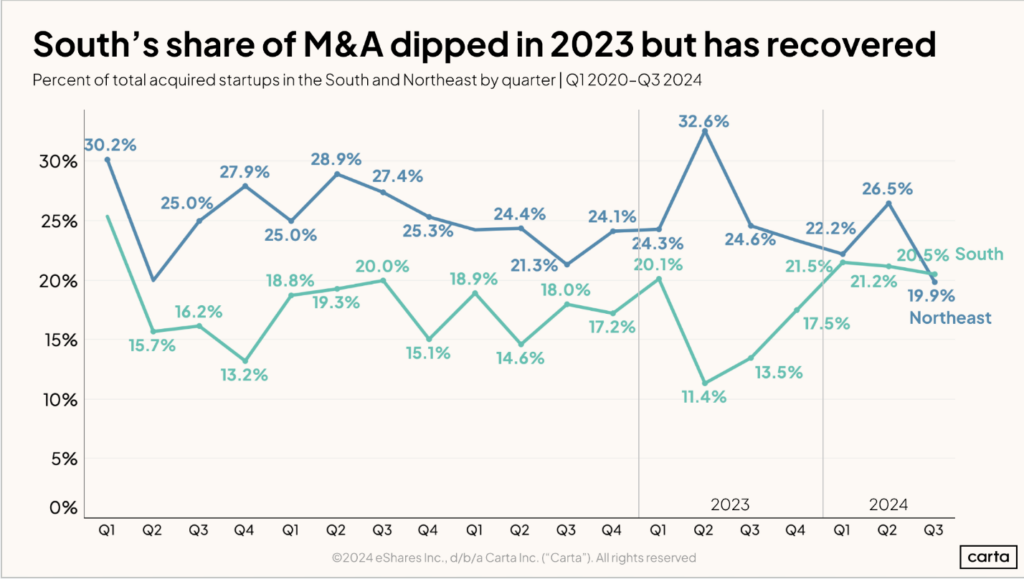

Walker’s data revealed several positive trends for the South’s venture capital ecosystem. Notably, the South is approaching the Northeast in terms of the share of venture capital rounds, and has surpassed it in M&A activity. “Venture companies can be built in the South, venture companies can be exited in the South,” Walker emphasized.

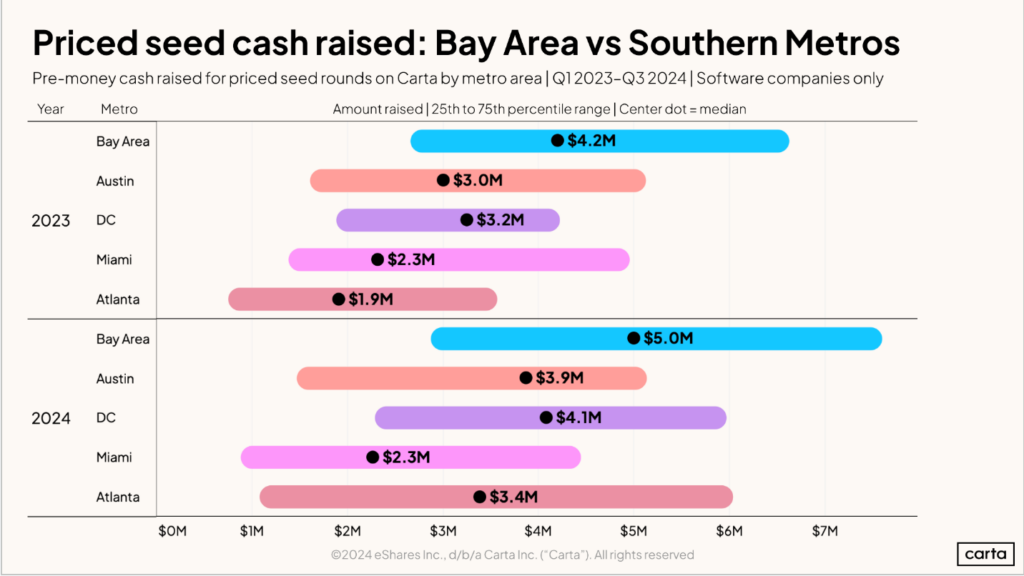

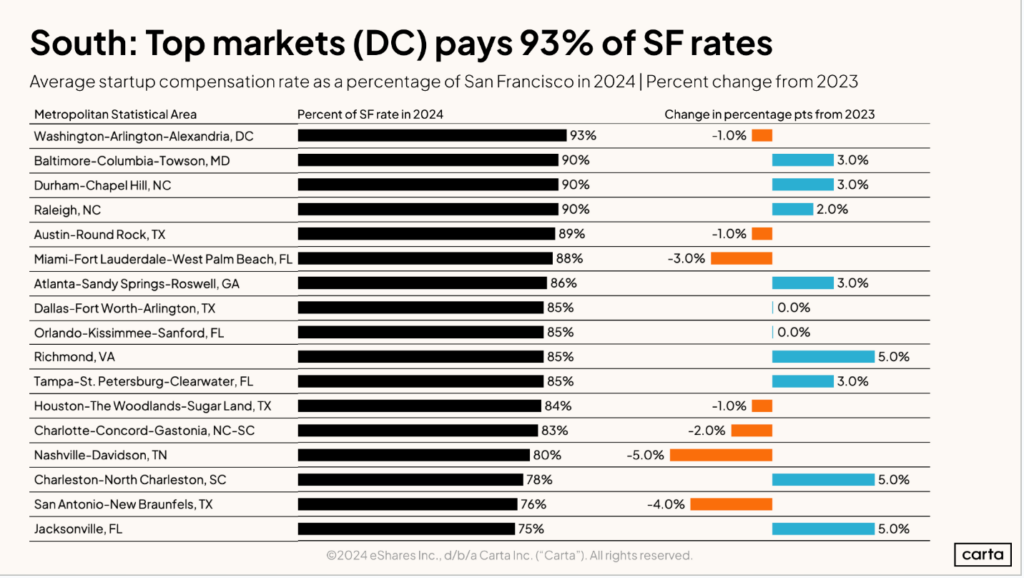

The data also highlighted the South’s attractiveness from a value perspective. Tech worker salaries in the South are generally lower than in tech hubs like San Francisco, but when adjusted for cost of living, many Southern cities offer greater purchasing power. This makes the South an attractive option for startups looking to optimize their runway and attract talent, further bolstering the appeal of Southern seed-stage venture capital opportunities.

The data also highlighted the South’s attractiveness from a value perspective. Tech worker salaries in the South are generally lower than in tech hubs like San Francisco, but when adjusted for cost of living, many Southern cities offer greater purchasing power. This makes the South an attractive option for startups looking to optimize their runway and attract talent, further bolstering the appeal of Southern seed-stage venture capital opportunities.

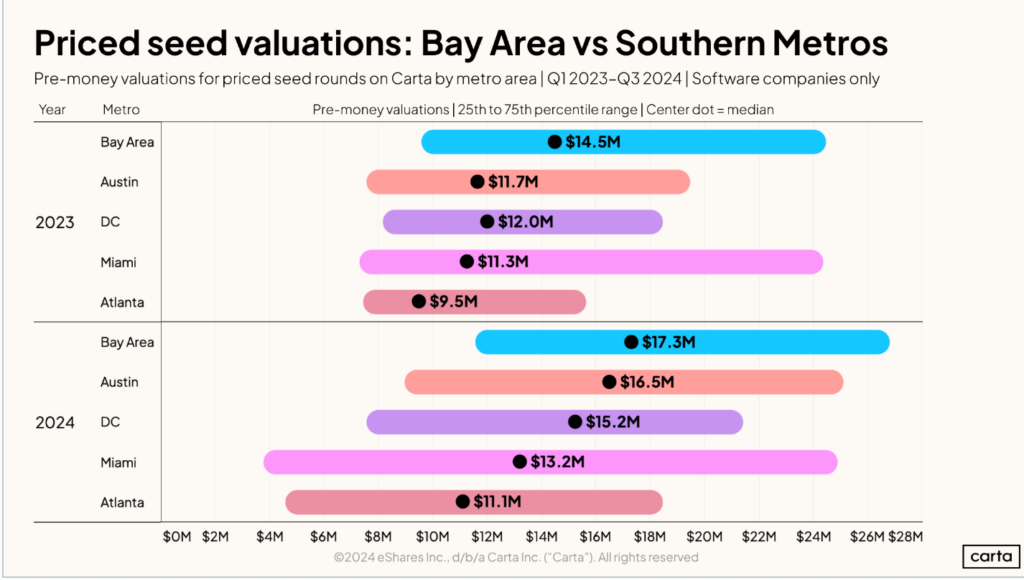

When the clear cost of living differential is considered, the priced seed capital raised by founders from Southern VCs is on par with capital raised in the West. While there are still slightly more dollars raised per seed round, founders in the South tend to be able to build more cost effectively, making the net effect on par. The top cities in the South are paying up for top startups to a point that it practically erases any previous advantages founders had finding funding on the coasts.

Unique Dynamics and Investor Focus in Southern Seed-Stage Venture Capital

Unique Dynamics and Investor Focus in Southern Seed-Stage Venture Capital

Walker’s insights into the seed stage were particularly illuminating. While the median pre-money valuation for seed-stage companies has reached new highs, this is largely due to a decrease in the number of rounds at the lower end of the valuation spectrum. The high end of the market remains competitive, with AI-focused companies commanding significant premiums.

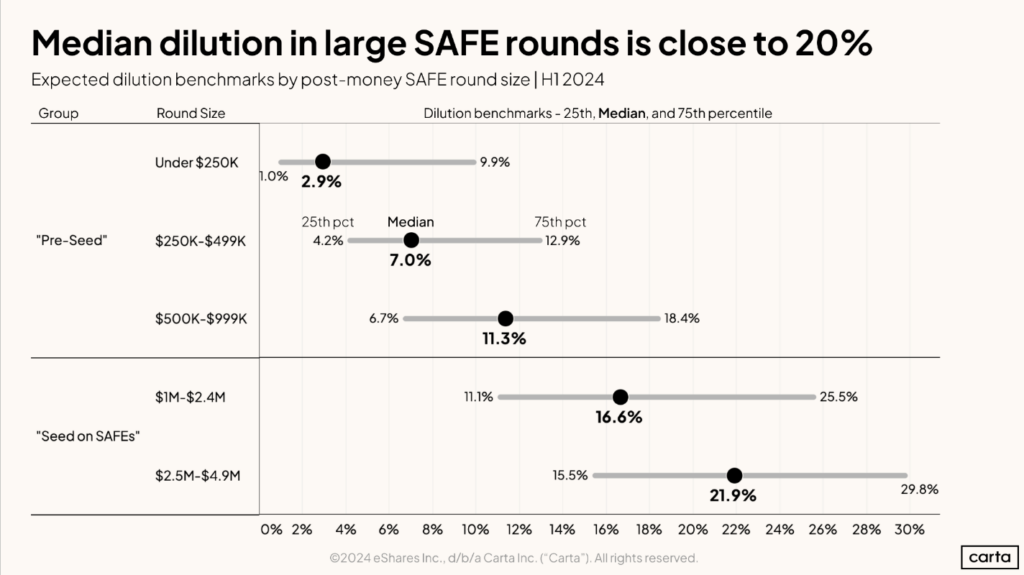

For investors, the most crucial aspect of seed-stage investing lies in understanding dilution. Walker stressed that founders should focus on the percentage of ownership they are giving up rather than fixating on valuation caps. “Safes are not free,” he warned. “They come with dilution. And that is what you should be focused on.”

In the video, Peter offered some wise words for founders who “stack safes”–well worth a listen if yo’ure considering doing your “seed round” by SAFE.

Key Takeaways for VC Investors and LPs

Walker’s presentation underscored the importance of a nuanced understanding of the current venture landscape. Investors need to recognize the disparities between the high-flying AI sector and the broader market, and adjust their expectations and strategies accordingly.

The South, with its growing ecosystem and value proposition, presents an attractive opportunity for investors seeking promising startups and a more balanced risk-reward profile.

As the South continues to gain momentum, understanding the dynamics at play, particularly at the crucial seed stage, will be essential for success in this evolving landscape.

-Lisa Calhoun