This week, our team was honored to be featured by the National Venture Capital Association (NVCA) in their article on emerging managers in the U.S. pushing the VC industry forward, authored by Devin Miller. We’ve excerpted a few segments here–read the whole story on the NVCA Blog.

Emerging Managers Pushing the VC Industry Forward

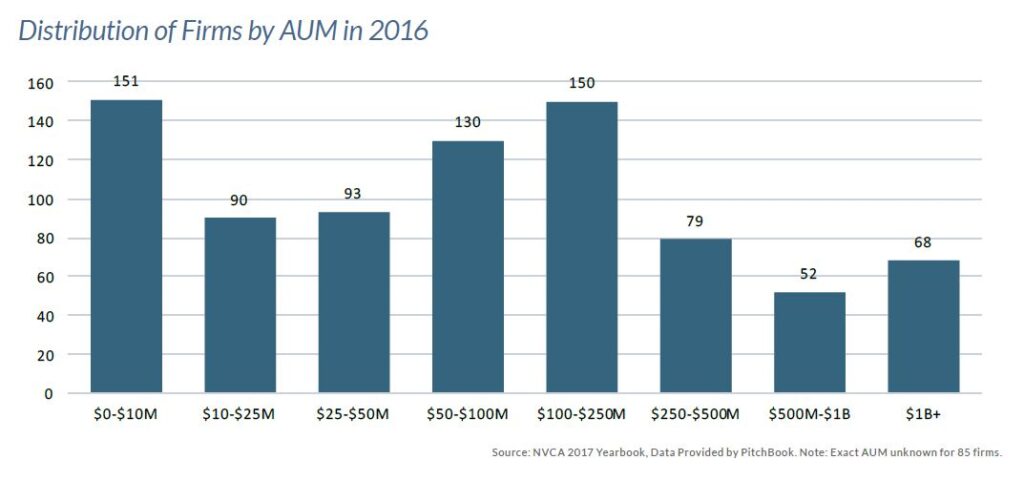

The formation of new venture capital funds is critical to the future of innovation. What does it take to become a venture capital investor? Emerging managers—teams raising their first venture capital funds—face myriad challenges in the process of getting their first funds off the ground. Which limited partners should Emerging Managers target? What are the best approaches to developing and articulating an investment thesis? How can fund managers approach building a top-flight team of investors, advisers and experts? Very few succeed. According to the 2017 NVCA Yearbook, commitments to venture capital funds reached a ten-year high, with 253 venture capital funds raising 41.6 billion last year. Of all funds raised in 2016, only nine percent were first-time funds…

What does it take to be successful as a new venture fund manager? How are next-gen VCs driving new investment strategies? To answer these questions and to get to know the future leaders of our industry, we reached out to some of our newest NVCA members.

Approaches to differentiation

“For new managers, you really have to prove yourself out there, more than the more experienced managers,” said Constance Freedman, Founder and Managing Partner of Chicago-based Moderne Ventures and NVCA Member. Freedman launched Moderne Ventures after launching and managing Second Century Ventures, the strategic investment arm of the National Association of Realtors. Moderne Ventures’ approach is multi-faceted: the firm invests in early stage real estate, finance, insurance and home services industries companies and supports companies through its Moderne Passport program.

“It’s good for emerging managers to have an angle to differentiate themselves,” said Amy Gu, Managing Partner of Palo Alto-based Hemi Ventures and new NVCA Member. “As a former entrepreneur, I had the experience of building and growing a company from a very small to a very large size, which gave me great experiences and connections for becoming an investor and helped give us our angle of being a ‘helpful’ VC for founders.”

“We’re very patient with our companies. We like to help founders in the areas they need to learn more, which is usually less on the tech side and more on the business side, learning how to fail fast, try new things, work on it, and make the turnaround faster than others,” said Gu.

“The major VC firms are pursuing larger and larger funds that tend to focus on mid, late and growth stage; first time check writers are at an all time low,” said Lisa Calhoun, Managing Partner of Atlanta-based Valor Ventures, who recently joined NVCA. “That leaves a gap where seed investors like Valor are able to source premium deals. Another plus is that limited partners get more choice than ever in picking a fund strategy that’s right for them.”

Innovative investment models

Another noteworthy feature of emerging managers is that many of them have created new or different models for their firms and for making VC investments.

…

Valor Ventures in Atlanta invests in hypergrowth platform tech. They launched a pitch competition for minority-led startups that’s separate from the fund and is run as a public non-profit foundation. Calhoun says Startup Runway has become the largest pitch series for women- and minority-led startups in her region. “We realized our dealflow should represent the full spectrum of tech entrepreneurship, and owning the pipeline helps us do that. We benchmark our pipeline so that we know our sourcing strategy is working,” said Calhoun.

Next-gen investors building inclusive ecosystems across the U.S.

Inclusion is a cornerstone of NVCA’s mission. We focus on recruiting and supporting venture capital firms led by women, underrepresented minorities and other underrepresented groups in regions across the U.S. to increase NVCA’s ability to drive a positive impact on the ecosystem.

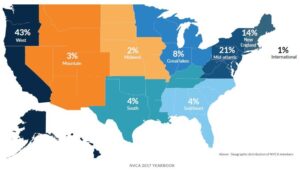

Today, 40 percent of NVCA members are located outside of the top three major U.S. venture markets: the Bay Area, New York and Boston. As the national trade group for the venture industry, we are the effective advocates for pro-innovation policy when we leverage the collective perspective of venture investors across the U.S. Insights from investors and entrepreneurs in Charleston, Pittsburgh, Madison, Omaha, Atlanta, Nashville, Dallas, Cleveland, Ithaca, Philadelphia, and other emerging ecosystems play an important role in shaping our policy agenda.

Today, 40 percent of NVCA members are located outside of the top three major U.S. venture markets: the Bay Area, New York and Boston. As the national trade group for the venture industry, we are the effective advocates for pro-innovation policy when we leverage the collective perspective of venture investors across the U.S. Insights from investors and entrepreneurs in Charleston, Pittsburgh, Madison, Omaha, Atlanta, Nashville, Dallas, Cleveland, Ithaca, Philadelphia, and other emerging ecosystems play an important role in shaping our policy agenda.

…

“The Southeastern part of the country has 40% of the U.S. population, so there’s a lot of entrepreneurs in this area,” said Calhoun. “We invest outside of the Tier 1 cities. There’s a lot of opportunities in those areas that far fewer investors are looking at.” So far, they’ve made investments in Effingham, IL; Austin, TX and Brooklyn, NY.

“We can find really high performers outside the major cities since you really have to succeed in those environments. Startups have to find product-market fit and revenue much faster since they need to be making money before they even meet an investor,” Calhoun continued.

___________________

This was just an excerpt from a larger story on the NVCA Blog with more graphs, figures and examples drawn from emerging managers like Moderne, Illuminate and more. Read the full report.