Valor 2024 Seed VC Mid-Year Update:

Southern Startup Investors Poised for Returns

Welcome to Valor’s Seed Stage Mid-Year Update, highlighting key trends and data for startups in the US Census South Region. This report offers a deep dive into the state of venture capital (VC) investments focusing on the South’s unique position in the national landscape. The insights derived from Pitchbook data and Valor’s analysis paint an optimistic picture for Southern founders and startups. Valor’s strategy, leading seed stage VC investments in the South, gives us a unique lens on the data. So far this year, we’ve reviewed 628 new opportunities, and you can learn more about our pipeline and dealflow in this recent report.

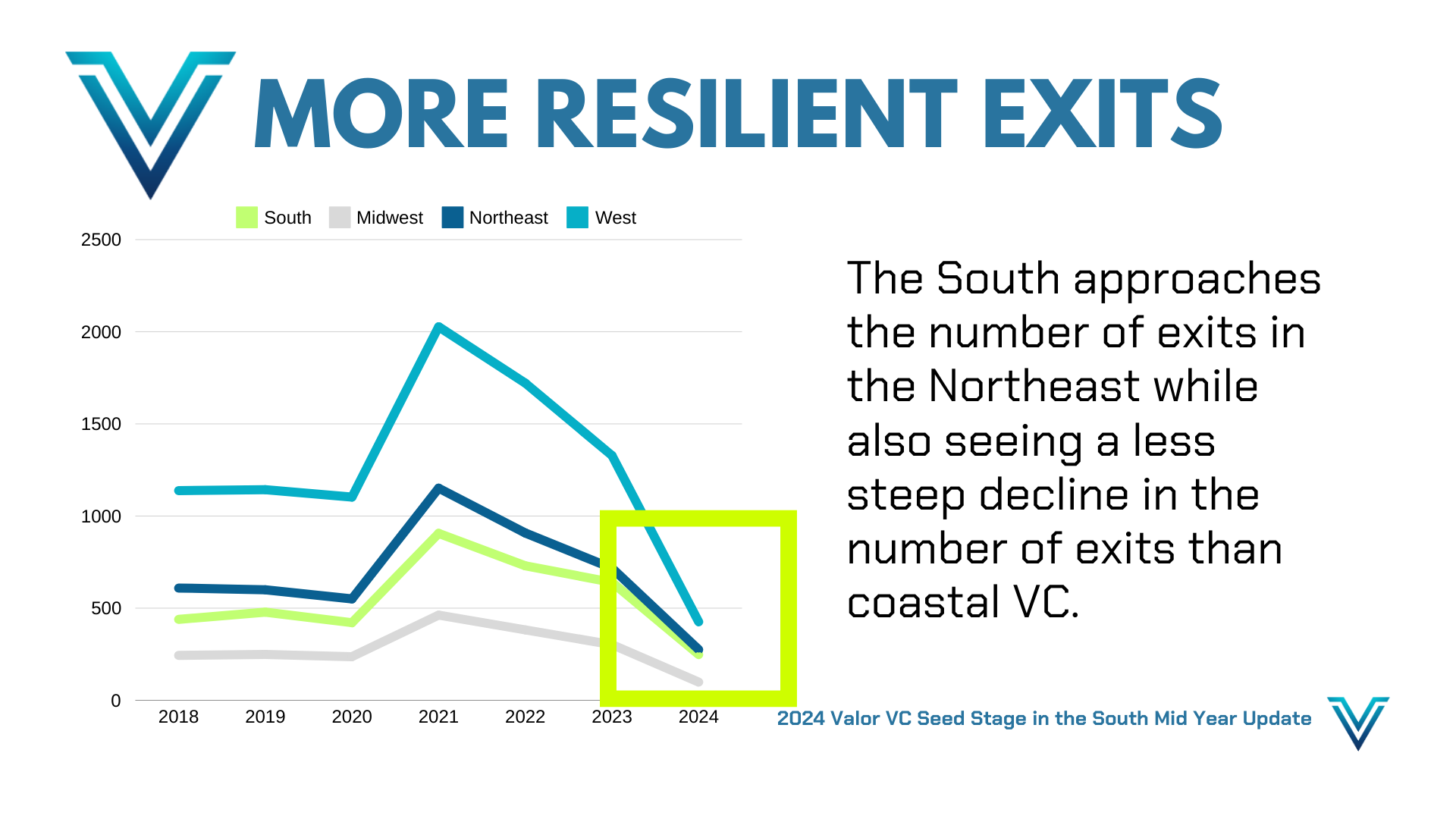

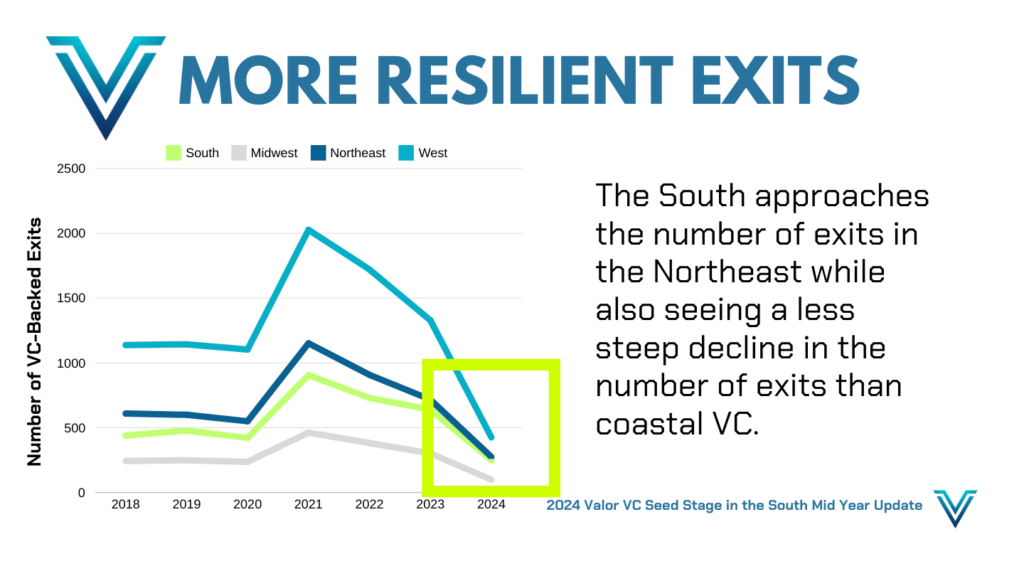

Exits and Investment Resilience from Southern Startups

The South is making significant strides in terms of successful exits. Historically, the Northeast has outperformed the South by nearly 200 exits annually. However, in 2023, this gap shrunk to just 77 VC-backed exits. This trend indicates increasing investor confidence and the region’s growing ability to nurture successful startups.

The South’s resilience is evident as it approaches the number of exits in the Northeast while experiencing a less steep decline compared to the West. This resilience underscores the South’s potential as a fertile ground for startups. When thinking of causes, we can’t help but believe it’s connected to the relative lack of capital for startups in the South–many of them develop deeper customer relationships and are more supported on actual revenues than investor pocketbooks.

The South’s resilience is evident as it approaches the number of exits in the Northeast while experiencing a less steep decline compared to the West. This resilience underscores the South’s potential as a fertile ground for startups. When thinking of causes, we can’t help but believe it’s connected to the relative lack of capital for startups in the South–many of them develop deeper customer relationships and are more supported on actual revenues than investor pocketbooks.

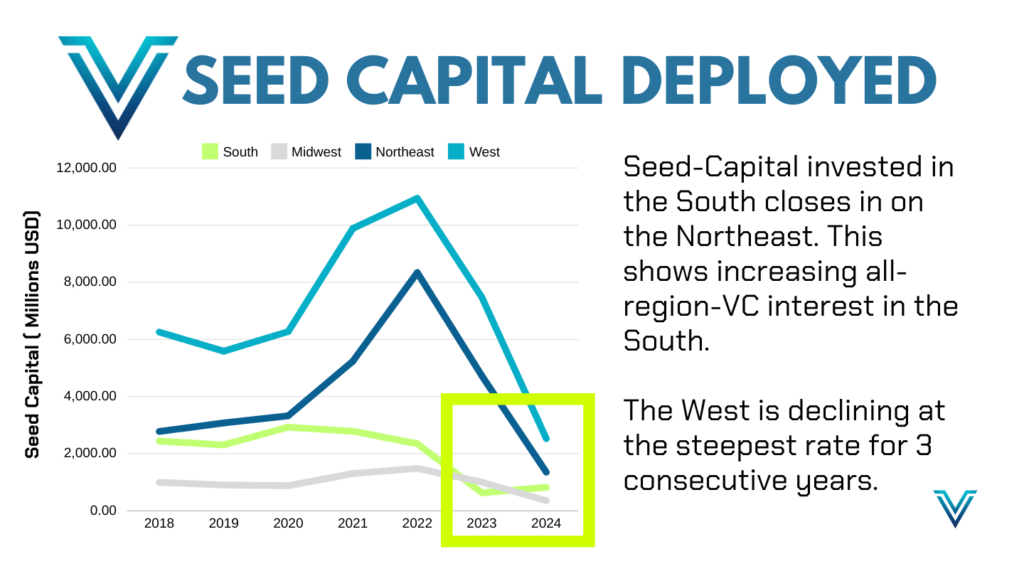

Seed Capital Deployment and Investment Per Capita by Region

The South is nearing the Northeast in terms of the total amount of seed capital being deployed.

The chart on seed capital deployment shows that the South is closing the gap with the Northeast, despite the West’s steep decline. This increasing interest from VCs across all regions highlights the South’s growing appeal to returns-focused VCs, most of whom have to fly to the region to find deals at this stage. VCs from outside of the South are filling the gap created by LPs not investing in the region at the scale the opportunity merits. This increasingly puts a burden on Southern founders who don’t want to leave the region, but do want core support from a local seed lead VC.

The chart on seed capital deployment shows that the South is closing the gap with the Northeast, despite the West’s steep decline. This increasing interest from VCs across all regions highlights the South’s growing appeal to returns-focused VCs, most of whom have to fly to the region to find deals at this stage. VCs from outside of the South are filling the gap created by LPs not investing in the region at the scale the opportunity merits. This increasingly puts a burden on Southern founders who don’t want to leave the region, but do want core support from a local seed lead VC.

The South’s local per capita investment available–dry powder–is almost a quarter of the Northeast’s, underscoring the need for more localized investment to support the region’s large population of approximately 128 million people.

The fact is clear–many LPs are paying a premium to support investors from outside of the South coming into the region, with playbooks that may or may not be a fit for this fast growing region’s dynamic environment.

The fact is clear–many LPs are paying a premium to support investors from outside of the South coming into the region, with playbooks that may or may not be a fit for this fast growing region’s dynamic environment.

Directing more focus to seed VCs in the South would help unleash this potential, driving more innovation and economic growth.

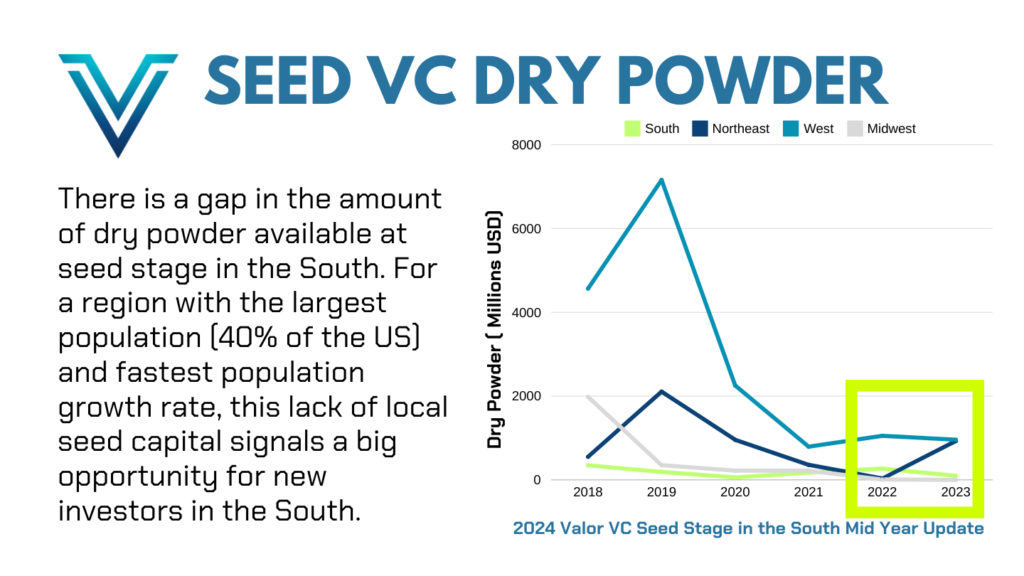

Dry Powder and Investment Potential for Seed Venture Capital

One of the standout insights from the report is the significant gap in dry powder available locally for seed-stage investments in the South.

The chart above illustrates the comparison of dry powder available across different US regions. This gap signals a tremendous opportunity for new investors to capitalize on the South’s burgeoning startup ecosystem by investing in more efficient vehicles–like local Southern VCs focussed on early stages.

The chart above illustrates the comparison of dry powder available across different US regions. This gap signals a tremendous opportunity for new investors to capitalize on the South’s burgeoning startup ecosystem by investing in more efficient vehicles–like local Southern VCs focussed on early stages.

Valor’s 2024 Seed VC Mid-Year Update presents a compelling case for more investment in Southern startups.

The region’s growing number of successful exits and the gap in per capita investment relative to the coasts all point to significant opportunities for new and existing investors. Take aways we have from the data include:

- Validation of our thesis that leading seed in the South is on trend with a huge, growing market–one recognized increasingly by all top seed investors, regardless of location;

- LPs may be missing out, or paying “more than they need to” to access this opportunity when they rely too heavily on VCs that do not have deep local networks in this high growth region;

- Founders in the South are learning to scale and exit well, driving transformational wealth on a scale almost equal to the startup ecosystem of the Northeast.

–Shrayes Gunna, Valor 2024 Summer Intern

Cornell University ’27

LinkedIn