Atlanta Venture Capital Is Booming

Valor is thrilled our firm has our roots and headquarters in Atlanta. Georgia is ground zero for one of the biggest opportunities for net new wealth creation in the country.

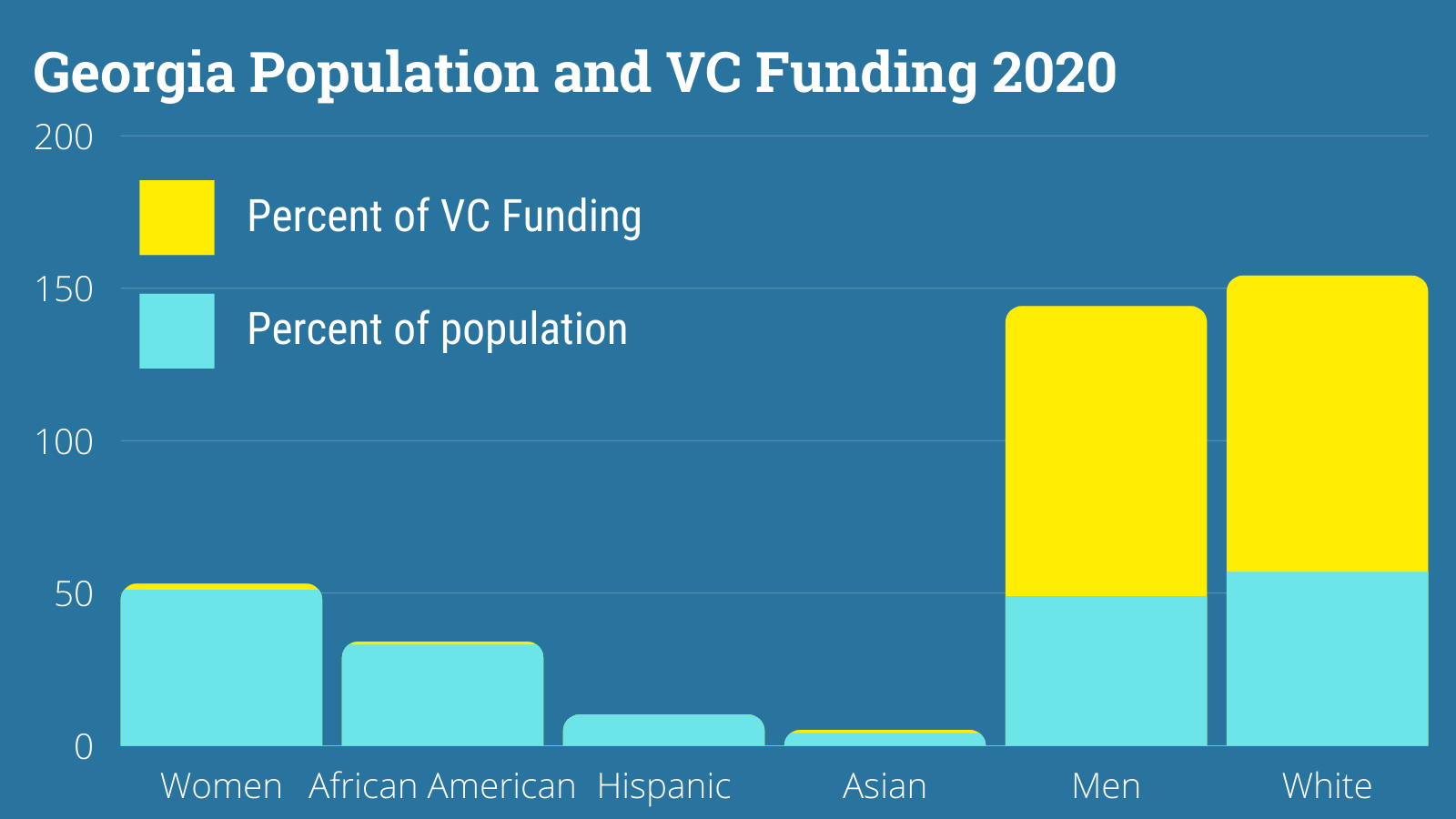

Georgia is one of the largest and most diverse states. We’ve created a hotbed for venture capital with over $2.1 billion dollars in funding over the last five years. Yet large discrepancies for underrepresented founders remain systemic. Thanks to Crunchbase adding its Diversity Spotlight feature, we’re able to pinpoint total funding and other important statistics of historically overlooked, underrepresented, and underfunded founders. In a state where over ⅓ of the residents identify as black or African-American, 9% Hispanic, 4% Asian, and 51% female, Georgia has done an exceptional job of engaging and attracting underrepresented founders. We done a poor job of funding them.

Snapshot of Georgia Venture Capital and Underrepresented Founders

| Ethnicities | % of VC in GA | % of the GA Population |

| African American | 1.32% | 32.60% |

| Hispanic | 0.003% | 9.90% |

| Women | 1.88% | 51.30% |

| Asian | 0.74% | 4% |

Note: While this Crunchbase data is not perfect, it gives a snapshot of the overall funding breakdown of underrepresented founders in nation’s 8th largest state.

The proportion of venture dollars is highly inconsistent when you look at each group’s representation in the state. Since 2016, Georgia has been the third leading state in funding for black-founded companies behind New York and California. While this paints an overall positive picture, a peek under the hood shows venture capital funding for African American founders actually fell 3% from 2019 to 2020. So “leading” can be deceiving. Even with more capital flowing to underrepresented groups over the last 5 years, the share of venture capital remains less to outright retreating for groups like women and founders of color. In fact, funding for female-led teams this last year suffered a five year low. And Asian Americans? Clearly not tracked consistently, which in itself is a form of denial.

Valor is looking to fund more female founders, founders of color and Asian founders

The next trillion-dollar market cap companies will come from the diverse and inclusive startups we are building today. With our roots here, we are deeply committed to the power of inclusion for creating net new wealth opportunities. While the numbers today are confronting, they are also motivating for our team. There is an enormous untapped wealth creation opportunity in serving the true diversity of innovators. Valor is committed to countering systemic bias with systemic inclusion.

Many of our Atlanta portfolio companies consistently in the local headlines are led by women and founders of color, like The Gathering Spot, LeaseQuery, Vital4, Capway and SmartCommerce.

While the numbers above only represent 2020, Crunchbase has documented an uptick in the funding of black-founded companies to $438M across 14 deals just in the first half of 2021. We are thrilled at the growth and success of our diverse and inclusive portfolio, and our sourcing program, Startup Runway, which consistently shares a high potential stream of under-represented founders with the broader venture capital community.

- If you’re an underrepresented founder building software, contact us.