Depending on where you learned about venture capital, you might think that any of these things drives investing:

- The intention to change the world and make it better

- A killer sales engine

- Entrepreneurial excellence / innovation

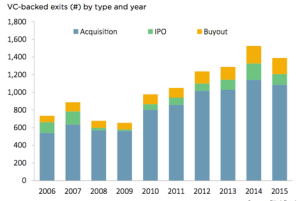

All of these things are fantastic, and to a lesser or greater extent they play a role, but the numbers are clear. What drives venture capital is corporate thirst for acquisition:

Acquisitions drives 72% of exit value and 78% of activity last year. That’s basically the same trend for the last ten years.

Most young companies that find customers well are going to be bought by another company for very specific reasons around corporate need for:

- derisking innovation,

- finding new, diversified income streams,

- creating pools of high class talent they can’t otherwise attract, and/or

- acquiring new customers more cheaply.Using these lenses, make a short lists of companies that might be interested in your startup after you start scaling your customers. It might broaden your thinking about the value you’re creating.