Maximizing Exit Potential As An Applied AI Startup

Understanding this is essential for founders and their first investors–firms like mine, Valor.

It’s the founder’s courage that creates innovation, so I’m going to use the founder’s lens to illustrate what I’m talking about. A startup founder today raises their first round of capital believing, thanks to thousands of Google search results and AI chat streams based on those results, that maximizing the initial seed valuation is in their best interests.

Maximizing initial valuation is not predictive of success. In reality, initial valuation has little correlation with wealth-generating outcomes. (Research.) In fact, overly optimizing initial valuation can work against high multiple, potential early exits.

Quality revenue is the single most predictive element of a great outcome. The path from there plays out differently in IPO-bound or M&A-bound startups . . .

Startups Seeking IPOs – bright spots, or not really?

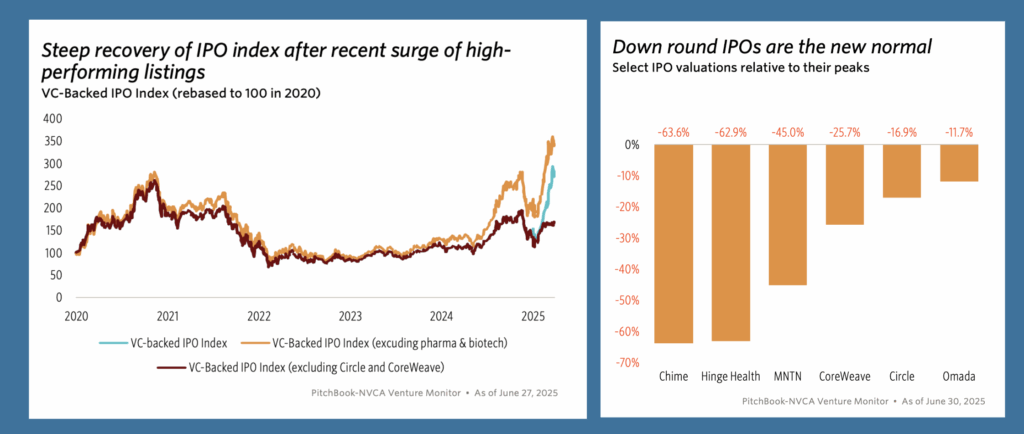

[caption id="attachment_8514" align="aligncenter" width="1024"] @Pitchbook Venture Monitor Q2 2025[/caption]

@Pitchbook Venture Monitor Q2 2025[/caption]Yes, the IPO window is back. Thirteen U.S. venture-backed IPOs priced in Q2 2025, raising roughly $6 billion. On paper, that’s progress. In practice, the majority of these companies debuted at double-digit discounts to their peak VC valuations (see second chart, above for some numbers).

For venture-backed startups, the IPO is no longer a victory lap; it’s often a down round with confetti. Late-stage investors absorb the brunt of that correction, but the dilution trickles all the way back. Founders lose leverage. Employees lose faith in their stock options. Even early investors may see muted multiples.

The IPO path, once the pinnacle of venture, has become the slow lane—capital-intensive, crowded with megafunds, and often disappointing in its payoff.

Is this the path you want for your startup? If so–it’s IPO or bust–here are some things to keep in mind as you choose how you scale:

- Get ready for 15-20 years of building, and a grueling cadence of quarter after quarter of up and to the right, or the markets will be ready to serve you a down round.

- As valuations recede into the stratosphere, the air becomes thinner for you as a founder. That energy you built the company with may, or may not, be the type of CEO that scales with multi-billion dollar valuations in your investors’ eyes. Big rounds, and down rounds, come with increasing board/investor controls on the original team.

- Finally, the money you make as a highly diluted founder is often not as huge a sum as you hope. Go inspect the math on some of these recent IPOs, and you’ll see what I mean.

Startups Seeking Smart Acquisitions—A Fast Lane for Applied AI

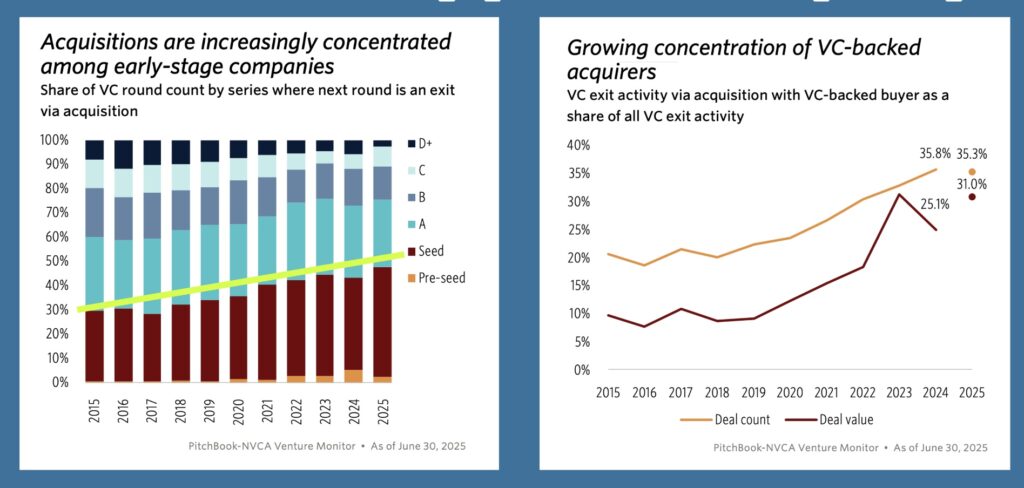

I think the option for startup founders today is the newer one. It’s focused, and in today’s market, more rewarding financially for the founding team, not to mention early investors like Valor. Right now, and for the foreseeable couple of years, corporates and VC-backed platform companies with valuations too massive to IPO today are in an arms race to acquire AI capabilities. (Interestingly, you’ll also see confirmation of this in how much corporate venture has pulled back on investing–they’ve moved into full on corporate development.)In H1 2025, most venture-backed acquisitions cleared $100 million.

[caption id="attachment_8515" align="aligncenter" width="1024"] @Pitchbook Venture Monitor Q2 2025[/caption]

@Pitchbook Venture Monitor Q2 2025[/caption]

From the charts above, I want you to note three things:

- The fact that almost 50% of M&A is happening before a Series A. This means Seed is the last capital half of all exit-bound founders raise.

- The trend, year after year, of more M&A happening earlier is a well-established one.

- A third of these acquisitions are VC-backed companies buying younger, VC-backed companies. When you’re on that long IPO route we discussed above, you have to do anything to grow–and buying faster growers than you is one of those options. Note how steep this trendline is.

Takeaways for Startup Founders In This New Reality

- Recognize the bifurcation available to you–build fast and lean, or big and bulky. Companies that miss both IPO scale and acquisition fit risk drifting into the messy middle. This is a founding team’s choice: make it consciously.

- Frame your expectations with today’s numbers. If you’re building toward IPO, know that SaaS multiples today hover near 5× forward revenue—down from 20× at peak venture. At $20 million ARR, you may be looking at a $100 million IPO valuation, not $400 million. Interestingly, the acquisition market in the early stage for applied AI is often paying a better multiple. Your quality revenue acceleration is the most important thing you can focus on for your future acquisition.

- Map your acquirers now. No matter the maturity level of your startup, look at who’s buying in your category now—Microsoft, Alphabet, Salesforce, or one of the AI consolidators. If they’re not already customers, they should be on your sales target list. Being indispensable to a buyer today increases your odds of being acquired tomorrow. Who's on today's Top 10 Most Wanted Target List?