The next era of venture capital is almost here. It may be the best yet. Here’s how it’s shaping.

The writing is on the wall for the current era of venture capital:

- VC returns? Sliding.

- VC funds? Vanishing.

- VCs? Often detached from today’s entrepreneurial grind, with mental models years out of date with today’s AI-augmented super-cycles.

SPACs, venture studios, crypto-funds and more have experimented with new VC business models over the last decade. But here’s the truth: the problem isn’t the innovation funding model—it’s the evolution of the execution. Venture capital has become stale, and investors—and their LPs—feel it. Just look at the actions:

- Strategies swelling to mega sizes, mistaking scale for safety.

- Byzantine diligence processes, masking uncertainty with complexity.

- LPs pumping the brakes on the asset class, unsure if VC is capable of sustained value creation.

These challenges are precisely what the industry’s next era will solve, and often, it’s emerging managers who will do it. History shows us the type of thinking that creates the problem is not the type of thinking that will solve it, and so to help us understand the future, let’s take a moment to unpack VC’s past and how we got here.

The First Age of VC: Rocket Fuel for Research (1946-2000)

Venture capital didn’t begin on sunny California shores, but on the cold beaches of Massachusetts. The American Research Development Corporation (ARDC), founded by visionaries including Karl Compton and Georges Doriot, birthed venture capital. The unlock was structuring industrial wealth from America’s first families into scaling innovations– innovations that often came out of WWII, like flight, radar, and computing. Iconic firms like Greylock, Venrock (Rockefeller), and Draper emerged from ARDC. Early checks were $50K, $70K, and valuations were minuscule by today’s standards. This hard-tech, heavy-tech and even defense-tech oriented era only slowed with the dot-com crash around 2000, the close of the first golden age of VC.

The Second Age of VC: Bigger Isn’t Always Better (2000-2030)

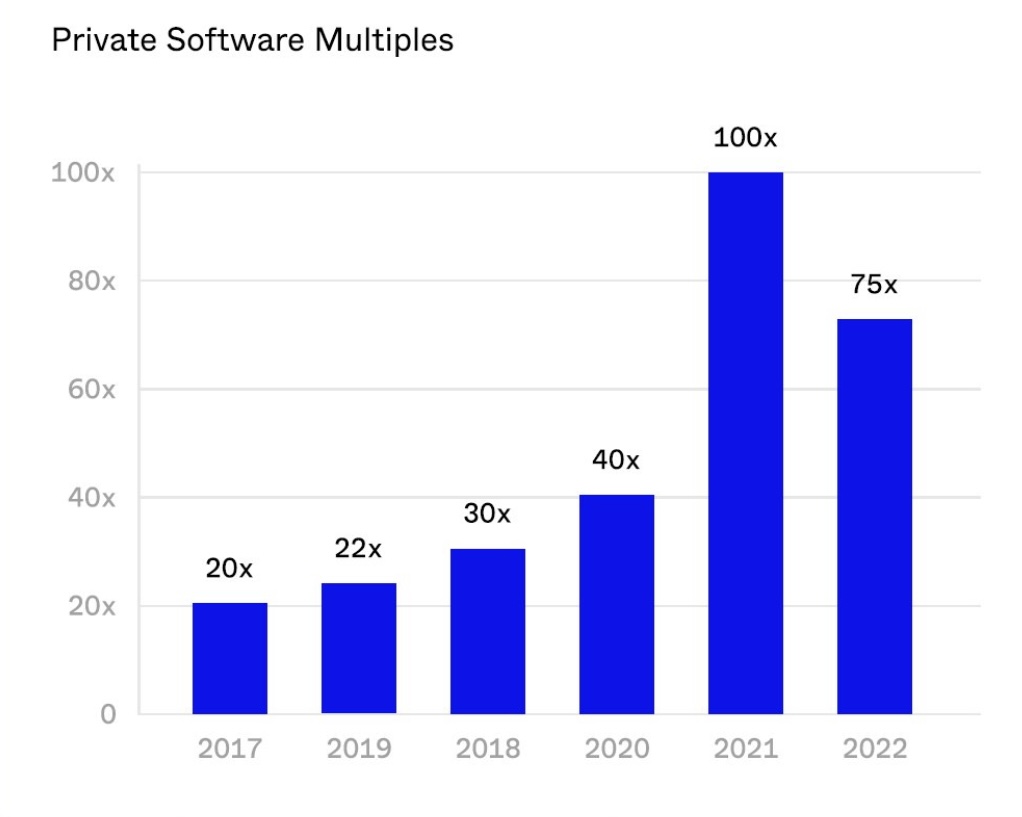

Post-dot-com, VC shifted year by year to an ever more aggressive “bigger is better” mantra. The idea was, big firms had the power to push returns, and so make big firms. You can see this partly in response to the pain of having so many “internet companies” die. (It’s not going to be that different with AI.) The solution was, make bigger ones–bigger companies, bigger funds to support them, bigger bets.

It looked like this and it was super fun while it lasted.

We are still in the final throws of this era. Some of the landmark infrastructure is obvious:

- Spray-and-pray tactics became mainstream – whole brands became devoted to them.

- Sky-high valuations and burn rates get increasingly celebrated as badges of honor (like FTX, Theranos, Juicero, WeWork)…unicorns, megacorns, etc. Raise more, get a bigger headline, get the magazine cover!

- Total-value-over-distributed-value became an obsession (TVPI over DPI).

- Mega funds chased mandate, with pay to play provisions supersizing multi-fund LP checks.

- Aggressive valuation inflation created funds whose whole pitch was, they would pay the highest price and “index innovation.” We all know how that came out.

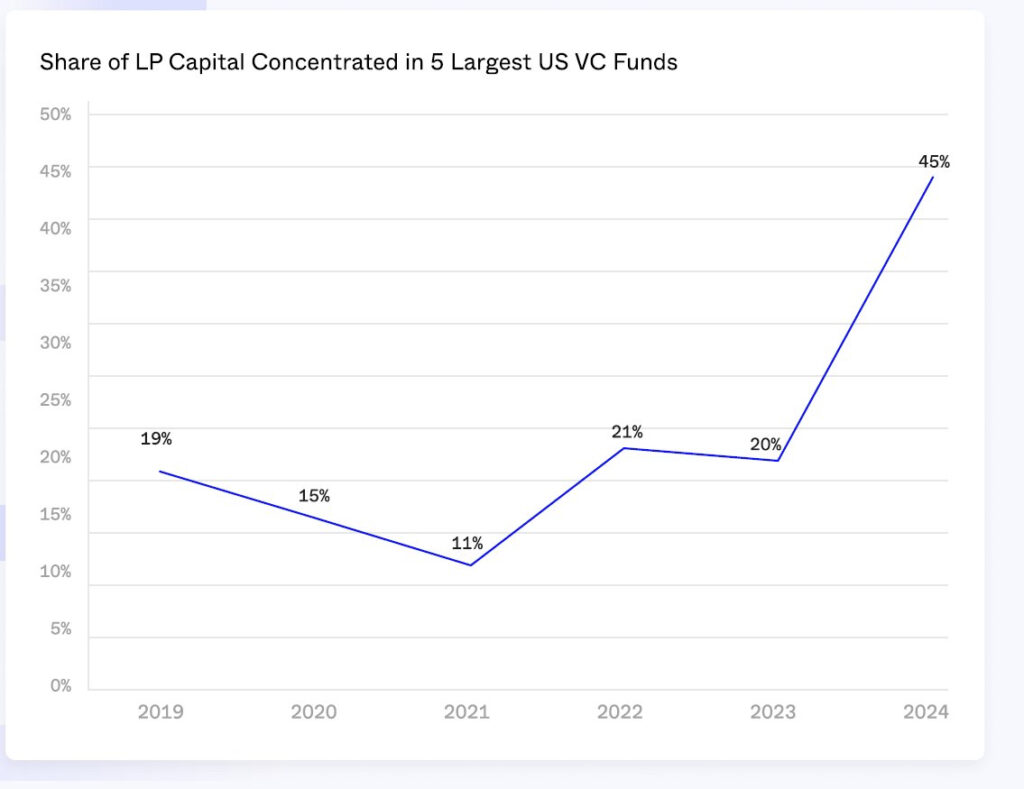

- LPs had trouble finding the fundamentals in this type of a market, and learned to “flock to safety” more than value. In 2024, only 508 VC funds closed–a significant decline from previous years. Just 20 firms captured 60% of the total capital raised. That’s concentration.

Current Reality: VC Repricing Itself

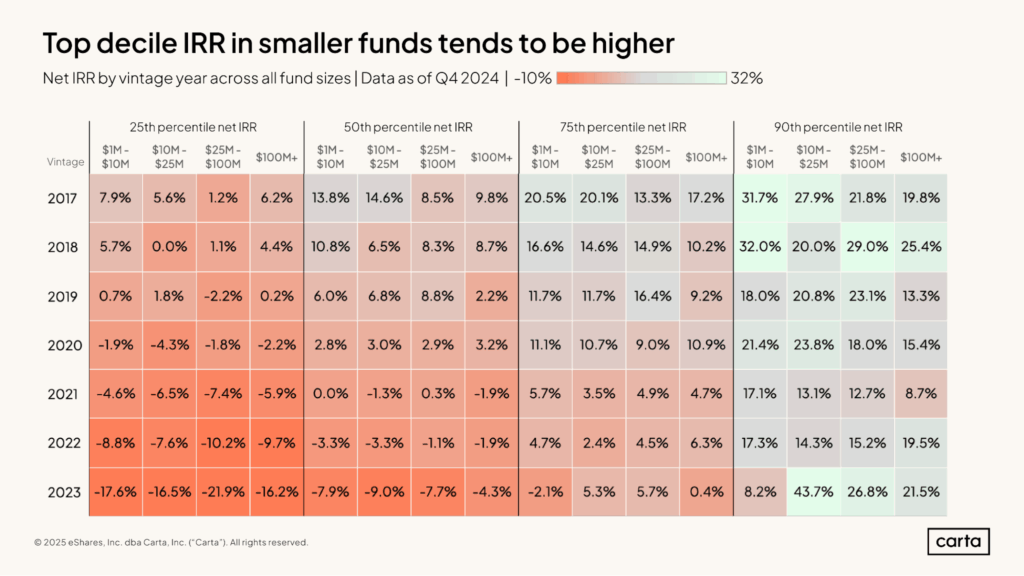

Now that innovation has been “indexed with enthusiasm,” you could say, the average VC value is in fact hitting “below the mark.” For example, according to Carta’s 2024 fund performance report for vintage 2020, the year of Valor’s first institutional fund, the 50th performance percentile for funds $25-$100M is 2.9%.

Many investors seeking returns from diversification are feeling some disappointment.

Many investors seeking returns from diversification are feeling some disappointment.

They can feel like today’s typical VC is trained more in wealth distribution than wealth creation. The message is landing. We’re in a cycle when the market is cleaning itself up considerably, and it’s painful. Here’s what the VC market repricing itself looks like by the numbers.

- Down rounds as a share of previous rounds are heading up–and up. No matter which Series is your favorite, the next investor is taking a hard look at the valuation proposed, and often saying no.

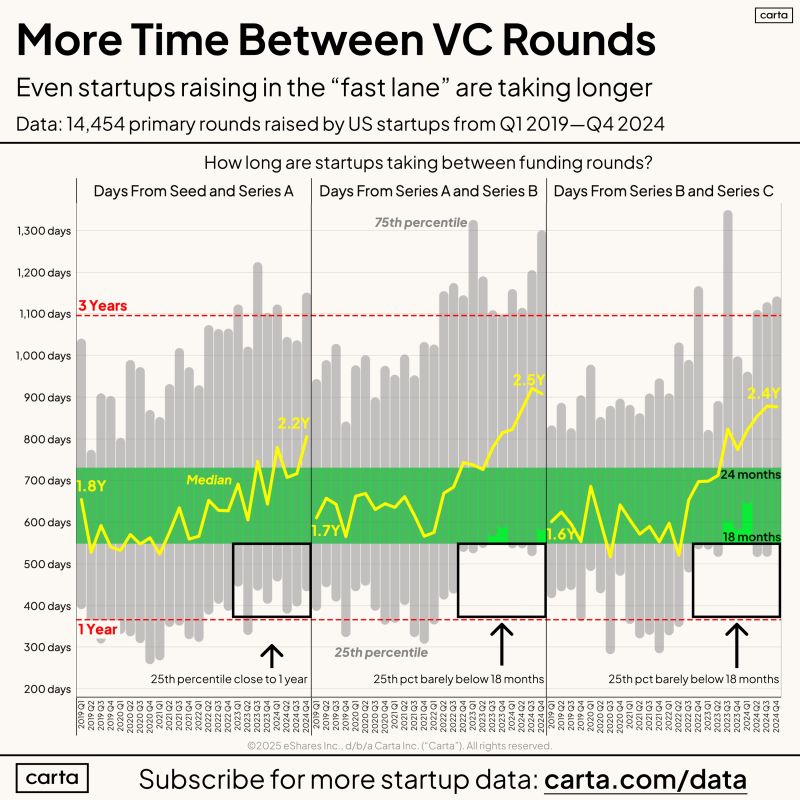

- Valuations aren’t the only haircut. These days, fewer startups than ever even make it to a next round, and when they do, it’s taking a lot more time.

This reset resounds beyond founders and startups, too, and I would argue is restructuring VC itself. Here’s how that is happening.

3. Between 2021 and 2024, the number of active U.S. venture capital firms decreased by over 25%, dropping from 8,315 to 6,175.

4. The number of new first-time funds fell by more than 75% from the highs of 2021, and

5. The share of LP capital concentrated in the 5 largest funds is almost half–45%.

Is 45% of LP capital concentrating in just five funds the future of innovation?

Is 45% of LP capital concentrating in just five funds the future of innovation?

Not likely. It’s not a smart bet, but it shows you how far the funding of innovation has moved into a zone where fundamentals mean less than feelings of safety, size, and familiarity.

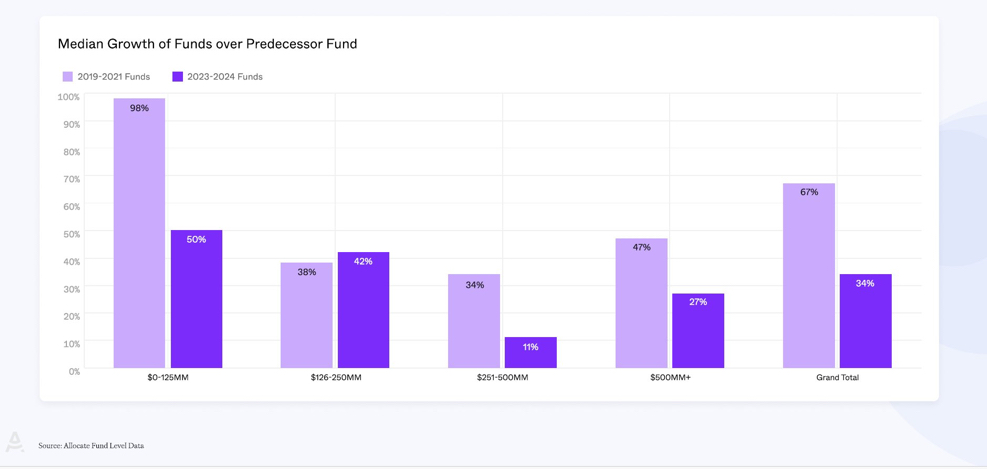

6. When not in the “top 5,” LPs are pulling back across the board, according to Samir Kaji’s Allocate data.

For those funds surviving, the average haircut on fund size itself is significant, indicating the general lack of confidence in VC itself as its currently run.

This necessary deconstruction of old venture capital is architecting the new era of innovation funding.

It can’t come too soon, because entrepreneurship in the U.S. is hitting records, and prior sources of early capital like federal funds are vanishing.

- Monthly new business filing averages in 2024 reached 430,000 new business applications a month, a 50% increase compared to 2019.

- Federal Reserve numbers show that post-pandemic, high tech entrepreneurship rates have never been higher.

Also interesting, it’s NOT the coasts that are driving the increases in new startups and tech businesses–it’s states “no VC ever looks at” like Colorado and Georgia.

- Georgia recorded 277,626 new business applications in 2023, ranking fourth nationally in per capita applications.

- Colorado saw a 116% increase in employer business applications in the fourth quarter of 2023 compared to the same period in 2019, the highest sustained percentage increase among all states.

To sum it up, the emerging VC era tackles landscape with more tech businesses scattered across a greater geography (ie, less of a coastal concentration), fewer VC funders in place, and less–much less–LP patience.

The Third Age of VC: Learning & Earning (~2025 – ?)

Valor is one of the early waves to implement AI across our investment management lifecycle. Our current AI is a suite of interconnected tools we call Vic. It helps us speed sourcing, competitive analysis, and our founder support platform without sacrificing quality.

People always ask me, how do we use Vic? Let me keep it simple.

- When I meet a new person, Vic does the data entry in our CRM.

- When I’m speaking with founders, Vic is taking notes and translating them into next tasks on strategy for our firm.

- When LPs ask us about reporting issues, it’s Vic that often takes a first pass at detailing the facts from our financial systems.There are many other ways we put it to work right now, and we also build every day.As a founder of a VC firm, I see competence in AI augmentation and lessons learned becoming a powerful moat over time in building a business based on wisdom, not just data. There are two major levers I think about in developing an AI that supports our unique lens on the market, and our role as a seed lead investor.

- One is regarding our Culture, and the other is our Cadence, or in other words, the activities we take that activate that culture in real time.

AI As A VC Competitive Advantage:

AI As A VC Competitive Advantage:

Valor VC

In a world augmented by AI, it’s not just the data that distinguishes our firm, although we do have a long tail advantage in over 7,000 companies we’ve met in the South–it’s the fluidity of access to it, and the wisdom to know what to do with it. We have programs like DeckCheck and Startup Runway that help us attract as close to 100% as possible of the opportunities within our strategy. But what do you do such a torrent when you have it? That’s where AI is particularly strong at helping us creating an operating culture of excellence. Let’s get specific about some of the ways it does that today.

- ADDING VALUE FOR OPERATING LPs. Many of Valor’s investment partners are companies also interested in a clear view of innovation without the filter of media or other biases. For them, we create regular reports on the founders we met from this large dealflow stream, and what they’re doing differently, by sector and even sub-sector. This allows Valor to increase our value to some of our financial partners while also increasing the signal from the market about what is more valuable today. Our AI is like a focussed team mining the first signals in our region and broadly sharing them with those who truly care about these faster, AI-driven evolution cycles. For some of our LPs, they aren’t necessarily intersted in the startups themselves–they want to see the stream of constant entrepreneurial concepts tackling hard problems in their industry.

- ACCESS TO PROVEN EXPERIENCE. Startup CEOs have long valued direct access to senior decision makers in VC firms–but the current, ending era of VC made having those types of relationships hard to achieve. Most founders who raised in the last few years can tell you how tough it was to get a partner meeting, and that they felt mired in armies of associates. Not at Valor. It’s one of our competitive advantages that our senior investing team is not just informed–we’re accessible, thanks in large part to the augmentation by AI that allows us to have confidence our infrastructure is delivering the intelligence we need to make the next best decision.One of my personal favorite ways Vic helps augment our team is in the founder nurturing process. Often, when we first meet a startup–because we’re so on the early signals before a Pitchbook or Crunchbase–they are too early for us to lead their round, and we want to see a little more maturity in the go to market motion. Vic is tracking the time the founder said he or she needed for the next milestone, and writes a custom followup deeply focussed on those milestones when it’s time for us to re-engage. This kind of syncopation was impossible even for the best teams at the biggest firmrs a couple of years ago. For us, it’s an operating standard.Sure, we are just as stuck “behind the computer” as anyone, but how we’re leveraging our time, thanks to AI, is different. We’re not chasing information, we’re putting it to work.

- FOUNDER MENTORSHIP. This time leverage has freed us to invest more deeply in founder education, including within our portfolio. Valor has programs like our Masterclass Series for founders, and Brave Boards Forum for board leaders, to translate innovation into lucrative exits one board meeting or one learned skill at a time.Because Vic is included in these meetings, we can put out timely, up to date materials for our portfolio, like a recent how to guide on hiring their first sales leader, or this month’s masterclass on negotiating for a top exit. These programs are packed with the latest insights because AI has removed much of the friction of creation. Every Brave Boards session, for example, we’re able to capture the top lessons learned from across all of our boards, and put it into a focussed learning package, expanding our access to expertise and the foundation for our next board leader. In this way, AI makes us even more human-centered in our culture, more able to help people become the best versions of themselves in a supported environment focused on one thing: returns.

- PUSH-BUTTON COMPETITIVE INTELLIGENCE. With our data integrations into paid databases, we automate keeping tabs on not only our startups, but also competitive startups, including next rounds and valuations. We’re able to help our founders find the best path through to their next round–or acquisition–or secondary opportunity from data and experience, a powerful combination.

- FINANCIAL TRANSPARENCY AND ACCOUNTABILITY. Our AI takes financials directly from the accounting layers of our portfolio firms, allowing our team to see near real-time financial models and impacts. This allows us to plan and model with confidence, and keep our partners–our investors–tied in to what truly matters. We get regular feedback from our LPs that our transparency around portfolio performance is precise and refreshing.

- CAREERS. In the past, we used plug-ins and job boards to help make job opportunities visible in portfolio firms. Now, thanks to our AI layer, we’re able to directly identify and socialize Valor portfolio company career opportunities. Where a single job board plug-in could miss something that didn’t make it way through the API, our opportunity screen has a broader approach to helping build talent pipelines for our startups.

That’s how AI is helping our culture become ever more focussed on excellence and outperformance in a human-centered way. AI also augments the operating cadences that underpin our culture, and it’s worth touching on those things.

Specifically looking at cadence, here are some of the ways we have AI helping us accelerate our at-bats.

SOURCING. With our AI supporting sourcing by scraping news and data sites, we’re able to flatten managing a large geography, and provide 24/7 access to high quality input from our team for founders entering Valor’s pipeline. One example is our AI Vic is able to provide founders feedback on their decks in real time.

SOURCING. With our AI supporting sourcing by scraping news and data sites, we’re able to flatten managing a large geography, and provide 24/7 access to high quality input from our team for founders entering Valor’s pipeline. One example is our AI Vic is able to provide founders feedback on their decks in real time.

- Try it for yourself–send an early stage deck to Valor by uploading it here.

If a founder doesn’t want to wait to take a meeting, they can substantially get Valor’s feedback any time this way, because our AI is trained on our strategy and view of the market, not just generic startup data.

PRIORITIZATION.Valor’s AI analyst, Vic, continuously ranks and prioritizes investment opportunities, accelerating diligence and monitoring at superhuman scale, and reaching out to founders proactively when the milestones they said they were waiting on are ready. This way, founders see we’re accountable as a process–and expect the same of them.

QUARTERLY REPORTING. Vic is able to review board notes, founder mentoring calls, and financials to provide a high level summary of the major activities for each startup each quarter. This allows our board directors and team to add context and work from clear facts in a rough draft form when we prepare quarterly memos.

NEXT ROUND VISIBILITY AND FORECASTING. Because of the deep integrations we have with the financials of our firms, we’re able to forecast and model different opportunities more rapidly in our dynamic portfolio–this helps us speed the right next decision instead of waiting on the facts to become visible.

Thanks to building our own AI, Valor is transforming venture capital from a handcrafted, cumbersome operation into an agile, software-driven, decision support system.

By using AI to focus our portfolio with speed and precision, we aspire to make the path to returns radically transparent and accountable, with a high-touch, human-first approach.

Looking Ahead: The Capital of Innovation is Courage

It’s clear there are still many lessons to be learned in modernizing how innovation is financed. I expect we’re not done pruning VC firm cultures that don’t relentlessly apply intelligence. I liked a recent tweet from Samir Kaji that said “We are somewhere between the downslope and the beginning of an upslope of another tech market cycle.” That feels right.

While some traditional venture models may fade, I expect lean, action-oriented, tech-enabled firms like Valor will distinguish themselves with aggregating even better opportunities. Investors embracing the cultural evolution that comes with AI are setting the stage to be rewarded for their courage. Why courage?

Courage because it takes courage to move, when others are still in place.

It takes courage to go early into a re-invention of an industry like venture capital–before the sediment from this transition has settled.

In my years of raising Valor’s first two institutional funds, I can’t tell you how many LPs let me know it was frustrating for them to have:

- Started investing in venture capital at a period when they couldn’t get into the “top firms”–the allocations were set, or;

- Couldn’t get the allocation for VC they wanted because they were not writing a “big enough check” or;

- Were treated like the help instead of the customer, because of the culture of the “well respected, must have” VC tends toward the elitist.

The old structure is melting and the bones of the new structures for VC aren’t quite hard yet. The coming few years will reward investors who courageously embrace innovation’s evolving rules. I am inspired and grateful to be part of it.

–Lisa Calhoun

Sources:

Allocate: Fund Level Data Chart

Carta: Multiple charts, primarily sourced from Peter Walker posts on LInked IN. Carta is Valor’s fund admin, and we enjoyed having him speak to our partners recently about his view on the innovation happening outside of Silicon Valley.

Federal Reserve Bank of New York. Research: https://www.federalreserve.gov/econres/notes/feds-notes/high-tech-business-entry-in-the-pandemic-era-20240419.html?utm_source=chatgpt.com.

Emerging Manager Fundraising Decline Chart: Samir Kaji (Twitter, 6/3/2025)

Downrounds chart: SVP State of the market H1 2024

Pitchbook: Share of LP Capital in 5 Largest Funds Chart