Is Valor’s conviction the South is the next big opportunity in venture capital “on the money?”

Decide for yourself. I’ve compiled some of the latest numbers behind my radical belief that this region, currently among the least capitalized, is where the next big innovations will be launched, and should be capitalized.

- For clarity, when I say “the South,” I mean it as a technical term–I mean the U.S. Census South: the 16-state region defined by federal statistics (AL, AR, DE, DC, FL, GA, KY, LA, MD, MS, NC, OK, SC, TN, TX, VA, WV).

The Economic Engine in the South Is Leading the Country

1) Population scale

The South is the largest U.S. region by people. In 2024, it accounted for roughly 40% of the U.S. population—a domestic market larger than most countries.

If entrepreneurship were a “percentage of the population” problem — i.e., the number of entrepreneurs in a given area is derived as some standing percentage of the overall population — then the fact that this is the most populous region would stand on its own merit for investors looking for the next big thing.

However, it’s more than that — the Census states it plainly: “The South was the only region to gain population from both natural increase and net domestic migration.”

2) Fastest-growing region in the country

- Recent Census releases show the South led the nation in net domestic migration again in 2024. It’s not just the biggest–it keeps getting bigger.

- BEA data show above-trend GDP gains across many Southern states in 2023–2024 (BEA state GDP).

- The Financial Times describes Atlanta as a regional “growth engine” drawing global capital and STEM talent (FT).

The quality of that populat also matters of course, which is why it’s super compelling that the tech talent concentration in the South is dense, relative to other populations.

3) More tech-talent concentration

CBRE’s 2025 Scoring Tech Talent shows Southern markets are core nodes: Raleigh-Durham, DC, Atlanta, Austin, Dallas–Fort Worth, South Florida and others are among the highest-performing U.S. tech labor markets, with rapid growth in AI skills and STEM density. Huntsville leads CBRE’s “Next 25” emerging tech markets.

CBRE: “Tech talent remains heavily concentrated in a select set of markets, several of which are in the Southeast and Texas.”

4) Higher rates of entrepreneurship than coastal VC hubs

So more entrepreneurs, lots of tech talent, but you know what else–the population is simply more motivated to build. I get that from the rates of entrepreneurship, which outpace more complacent communities.

Let’s look at two complementary indicators:

- Business Formation (Census BFS): The South posts sustained high business-application volumes, with Florida, Texas, Georgia and Tennessee consistently among top states for new applications (Census BFS). Translation–more entrepreneurs are building companies here than almost anywhere else in the country.

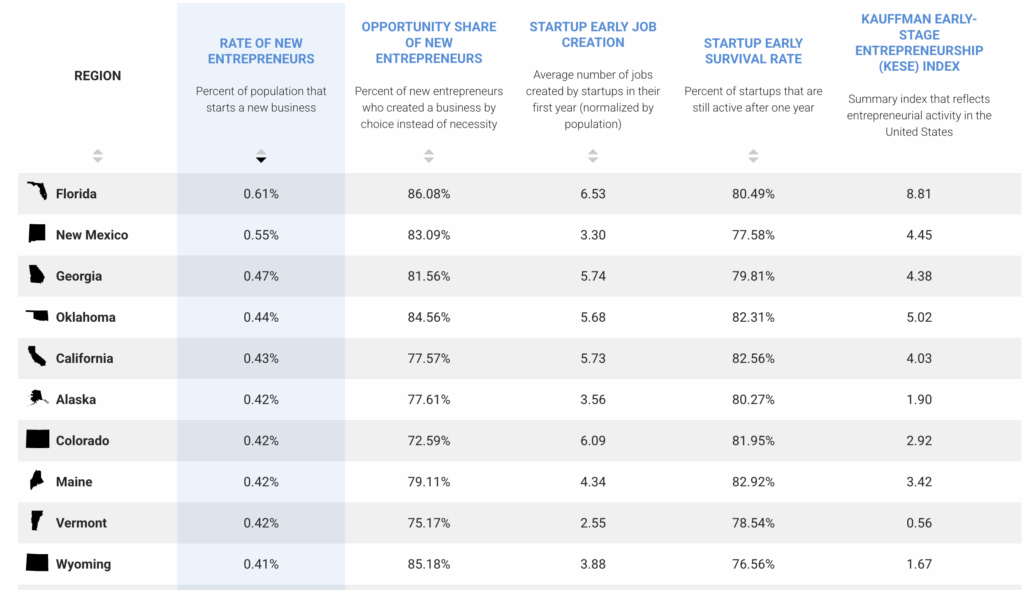

- New Entrepreneurs (Kauffman): Southern states like Florida and Georgia outperform more complacent states, like California and New York.

Kauffman Indicators

Across metros, Miami, Atlanta, and Nashville repeatedly rank at or near the top on new-business formation compared with Boston, New York, and San Francisco.

So we have more people, more motivated entrepreneurs–what else would a bottoms-up analyst want to see? Well, is the economy ready to support the growth of a young startup? Let’s look at costs of living.

5) Better costs of living (COLA)—a tail wind for entrepreneurs and their teams

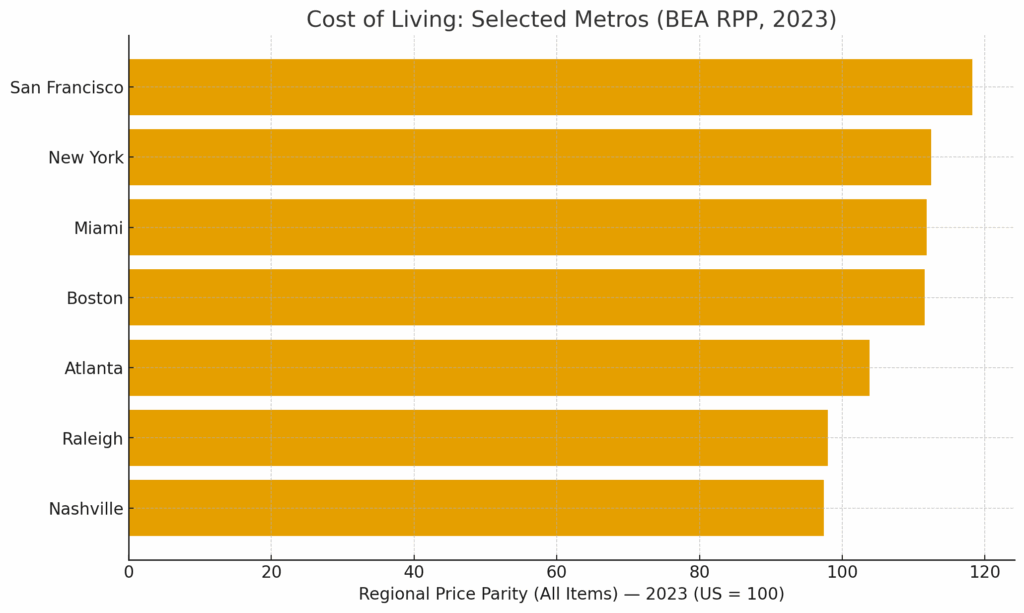

The Bureau of Economic Affairs Regional Price Parities (RPP) provide an apples-to-apples measure of price levels (U.S.=100). This is your classic index approach, where normal is 100 and larger numbers than 100 are “more expensive” and smaller numbers than 100 are “less expensive than average.”

Raleigh at 98 and Nashville at 97 show life there is simply cheaper than the US average, which is 100. San Francisco, at 118, and Boston, at 111, and New York, at 112, show double digit increases even over Atlanta (104).

Source: BEA Regional Price Parities via FRED (2023)

Data: cost_of_living_RPP_2023_selected_metros

Moving out of economic-index speak, for an entrepreneur with a household and a $120k founder salary, rent plus local services often run meaningfully lower in Atlanta/Raleigh/Nashville than any of the coastal hubs–with a global airport right in the back yard as a big bonus.

- If ~60% of a seed-stage burn is local wages/services, a 10–12 point RPP gap versus NYC/Boston/SF extends a $1.5M seed by roughly 2–3 months—enough for additional product cycles or another enterprise pilot window.

You can start to see why I truly believe the South is “venture paradise” for LPs who truly want to underwrite exceptional opportunities. There are a few other numbers that shade in the details.

6) Higher performing labor markets than other regions

For one, work is a culture in the South. As of late summer 2025, the South posted ~3.8% unemployment vs. ~4.2% in the Northeast and Midwest and ~5.1% in the West (BLS via FRED: South; Northeast; Midwest; West). This means there are more people ready to work, and the economy in general is running more efficiently than in other regions. It’s the kind of forward, growing economy that encourages talent to stay sharp.

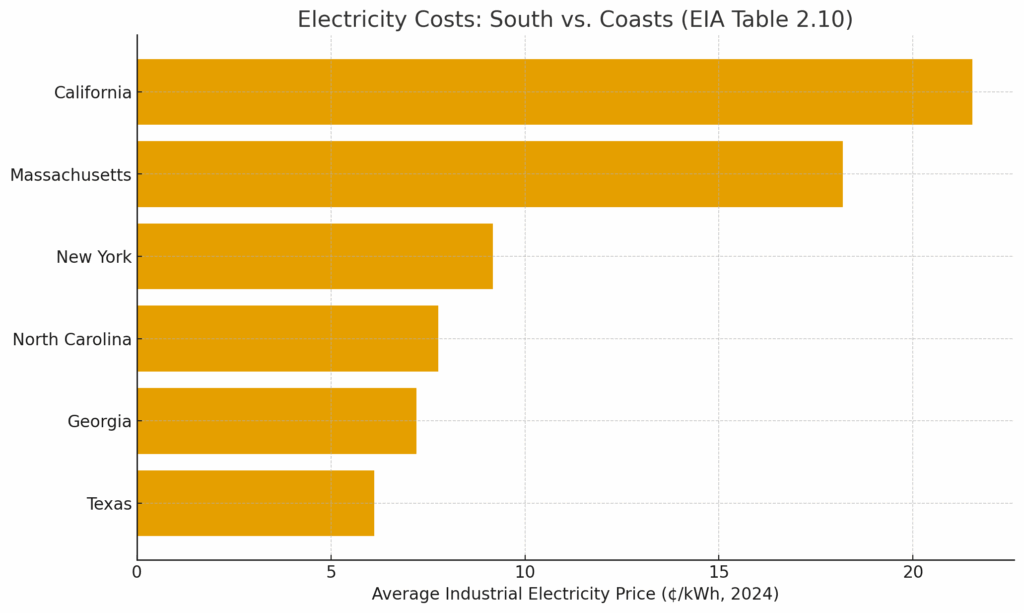

7) Better electricity costs and capacity for the AI era than other regions

Building in the AI era, you also are going to need a lot of energy, literally. Data-center and AI workloads chase reliable, affordable power. Industrial electricity prices in Texas (~6.1¢/kWh), Georgia (~7.2¢), and North Carolina (~7.8¢) compare favorably to New York (~9.2¢), Massachusetts (~18.2¢), and California (~21.5¢) (EIA, Electric Power Monthly).

Data: electricity_prices_industrial_2024_selected_states

Data: electricity_prices_industrial_2024_selected_states8) Highest regional wealth growth in the country

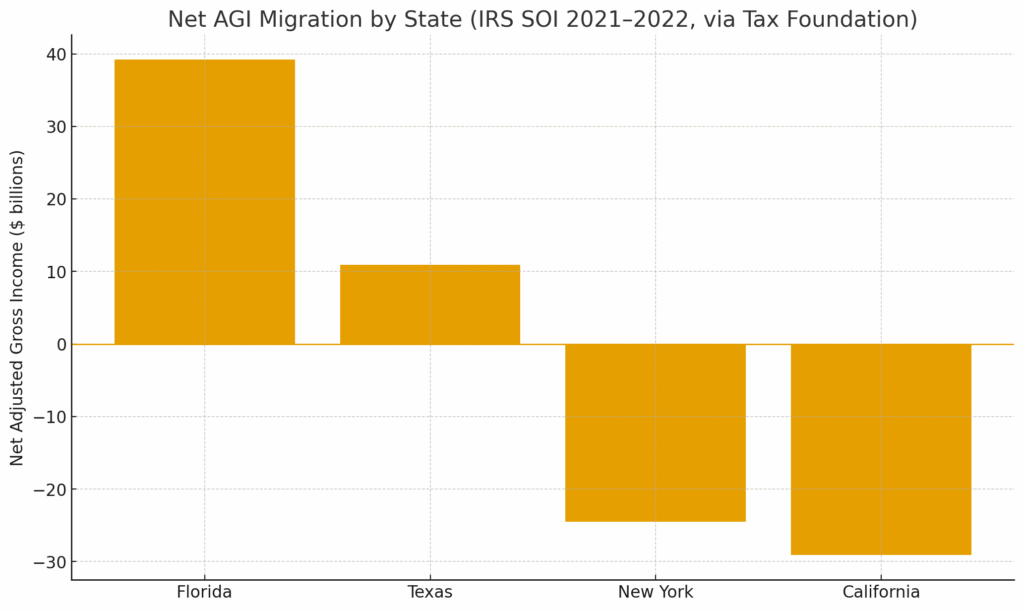

IRS income-migration data (SOI) show high-earning households moving South. This is a huge new phenomena that does not seem to be slowing down, but instead, picking up pace.

From 2021–2022, Florida (+$39.2B) and Texas (+$10.9B) posted the largest net gains in adjusted gross income, while California (−$29.1B) and New York (−$24.5B) saw huge outflows (Tax Foundation analysis of IRS SOI).

Data: net_agi_migration_2021_2022_selected_statesWe used to talk about our tech talent leaving, and creating our wealth elsewhere. That tide has turned.

Venture capital in the South

Despite its size and momentum on so many meaningful indexes, the South’s share of U.S. venture remains underweight.

- Carta reports the South captured ~11.6% of U.S. venture funding in 2024 (down from ~16.3% in 2023), even as firm formation and migration skew South (Carta geography).

- PitchBook–NVCA show similar concentration patterns in their 2025 Venture Monitor geography tables (PitchBook–NVCA).

So let’s take a beat.

9) Does the fact that the South is not saturated with venture capital predict worse, or better investments?

This is definitely for each LP to decide based on their own investment policy statement, but I’d like to share a thought experiment with you.

If founders were fish, and there was great fishing off the coast of California, it would make sense to send more boats, and bigger boats, to get more great fish, right? In the world of VC, that’s exactly what institutional LPs have done–sent more boats (VC firms) and bigger boats (VC firms). At some point though, the native fish population suffers. How would we know if we had “overfished the California coast?”

I suggest some of the ways we’d know that include slowing of returns, less DPI, and a retreat to more mediocre MOICs.

It’s a bit of a self-fulfilling prophecy–if you keep sending more money to the same place, expecting the same or better returns, there comes a time when it’s just not realistic, and I believe at seed, we’ve been there for several fund cycles on the coasts. Almost every niche is filled.

Even if that is not how you see it–and there are hundreds of VCs creating a lot of noise that what I suggest is happening is not the case–just the pure financial merits of the South standing alone would suggest it would be a productive, diversified place to put early-stage risk. As that develops, it will also mature into a great market for mid and late stage venture capital risk.

Valor is a pure seed-stage lead VC focussed 100% on the South.

I’m grateful to Valor’s committed investor community for seeing the vision of the future, and leading with courage and conviction. At Valor, our intention is to reset venture capital so that locally, it’s an industry our highest growth founders can rely on from the first round.

By the way, if you know a founder in the South raising their first round, let us know.

-Lisa Calhoun

______