As I travel discussing the opportunity Valor presents to sophisticated investors, I get questions on the Southeast, where our venture firm is headquartered. Some of those questions are on exits–what’s the climate like in the Southeast?

You know–HOT. Here are some of the exits in just the last year–not an exhaustive list:

| MicroMass Communications | MicroMass Communications acquired by UDG Healthcare | UDG Healthcare | 14-Sep-17 | $75,800,000 |

| eVestment | eVestment acquired by NASDAQ | NASDAQ | 5-Sep-17 | $705,000,000 |

| Numerex | Numerex acquired by Sierra Wireless | Sierra Wireless | 2-Aug-17 | $107,000,000 |

| NCI | NCI acquired by HIG Capital | HIG Capital | 3-Jul-17 | $283,000,000 |

| Comverge | Comverge acquired by Itron | Itron | 8-May-17 | $100,000,000 |

| TopTix | TopTix acquired by SeatGeek | SeatGeek | 19-Apr-17 | $56,000,000 |

| Preferred Systems Solutions | Preferred Systems Solutions acquired by STG Group | STG Group | 21-Feb-17 | $119,000,000 |

| Invincea | Invincea acquired by Sophos | Sophos | 8-Feb-17 | $120,000,000 |

We invest nationally and we love the value in the South.

Around Valor’s headquarters, there’s a great cost of living, serious natural resources, powerful education not only available but culturally valued, and plenty of people who want to work at reasonable rates. Put in a few nice-to-haves like a world class international airport, a deep water port, and a booming acquisitions landscape and you have all the makings of the next technology frontier.

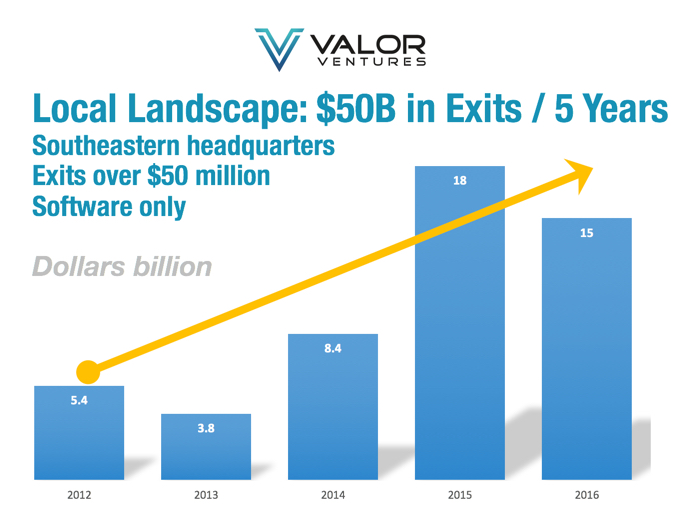

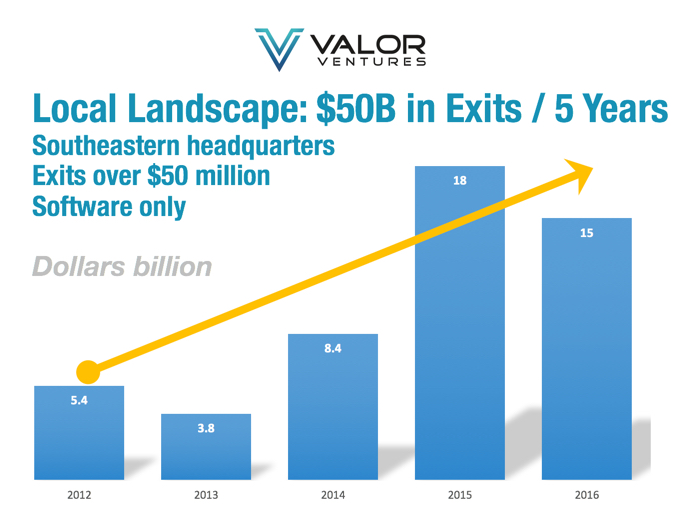

To put some numbers on the situation, I pulled a list of exits over $50 million from the Southeast in the last 5 years. To be on the list, the exit had to be $50 million or more and the company had to have its headquarters in the Southeast (not including Texas just FYI).

[table Id=6]The barchart shows a definite trend for Southeastern software firms.