I’ve had several conversations this week with founders about revenue per person (RPP). It’s not new—I used it twenty years ago when I was running Write2Market. But it’s having a moment again, especially as VCs prioritize capital discipline in these early days of the AI tech wave.

RPP is deceptively simple: total revenue ÷ number of employees (or FTEs). But behind the math is a lot of meaning. If you’re a founder feeling bruised because you’re not at $10M per person like Cursor or $1M like Microsoft, take heart—here’s how I think about RPP as a VC.

1. Is Your Startup Centering Wisdom, or Worker Bees?

A high RPP gets my attention fast. It tells me your team might be doing something with extraordinary intelligence: scaling with insight into automation, not just throwing people at a problem. At Valor, we invest in companies where human wisdom—not just data—is the scarce, valuable resource. Large language models made knowledge cheap–it’s practically a commodity. Wisdom? Still priceless. The smart ways you’ve automated your own business with AI help us see that clearly. (See more on Valor and the wisdom economy.)

- High and trending RPP can signal you’ve got some of the best people in your industry, creating some of the best tools.

2. Your GTM Magic Touch Matters

RPP only tells part of the story, though. As we dig in, I want to know your margin—how much of that revenue is real value creation, not just marketing spend? After all, you can spend a ton on adwords and lift revenue at any time, and that’s not sustainable. That’s where your “magic number” comes in:

Magic Number = (ARR Growth This Quarter) ÷ (Sales & Marketing Spend Last Quarter)

If your sales cycle is shorter than a quarter, run it monthly or over any meaningful time period that relates to your actual sales cycle. Anything above 1.0 is strong. This number shows how efficiently you’re turning go-to-market efforts into actual revenue. RPP tells me you’re automating. Magic number tells me how sustainable it is.

3. Don’t Be Blind To Burn

Here’s the final reality check: Net Burn ÷ Net New ARR. It’s your sustainability score. Under 1.0? You’re elite. Over 1.5? You’re lighting cash on fire.

A beautiful RPP doesn’t mean much if it takes $5 in Google Adwords to make $1 in MRR. That kind of math breaks hearts—and funds!—in this market.

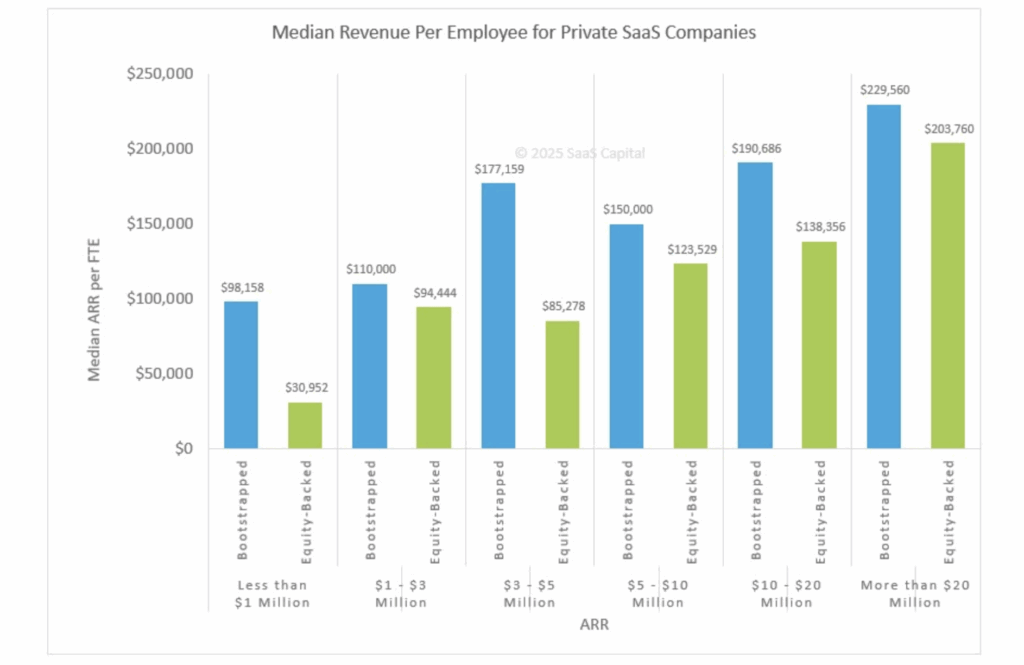

RPP Benchmarks for Startups

So, getting your head out of Tech Crunch click bait, for sure most SaaS founders aren’t at seven figures in RPP. SaaS Capital reports that startups who come to them looking for debt due to burn average in the low six figures. Given their client base, I interpret this chart as a starting line (after all, all their numbers come from debt applications). Wise founders will see how many multiples of these baselines you can manage with better automations.

Source: SaaS Capital 2025

Brave Founders Make Math Work For Them

Once you’ve found product-market fit and locked in your ICP, your RPP should be moving up and to the right. Here’s how to lead with clarity:

- Know your RPP. Track it monthly. It’s always amazing how few founders focus their team on clear tracking, and keep it front and center. All the fast growers do.

- Track your magic number. Watch GTM efficiency and use it–how does it inform what you’re willing to spend week to week?

- Watch your burn vs ARR. Build to win–and that means surviving to another day in these times when the only certainly about venture financing is, it’s more uncertain than ever.

Show Your Courage

I can’t wait to see your RPP! I love celebrating the brilliance of the founders who show us what they’re working on. Share your latest deck here, and as a thank you, you’ll get same-day, detailed feedback from Vic, our Valor AI.

-Lisa Calhoun